Click below to see the potential cost of your desired life after retirement. Click here for more details about HSBC Retirement Monitor.

What is the HSBC Retirement Monitor

Many people say they are trying their best to save for retirement, but not everyone has an idea of how much savings they need to support their expected retirement lifestyle.

Retirement life depends greatly on the plan you make today. The sooner you start planning, the more secure your retirement will be.

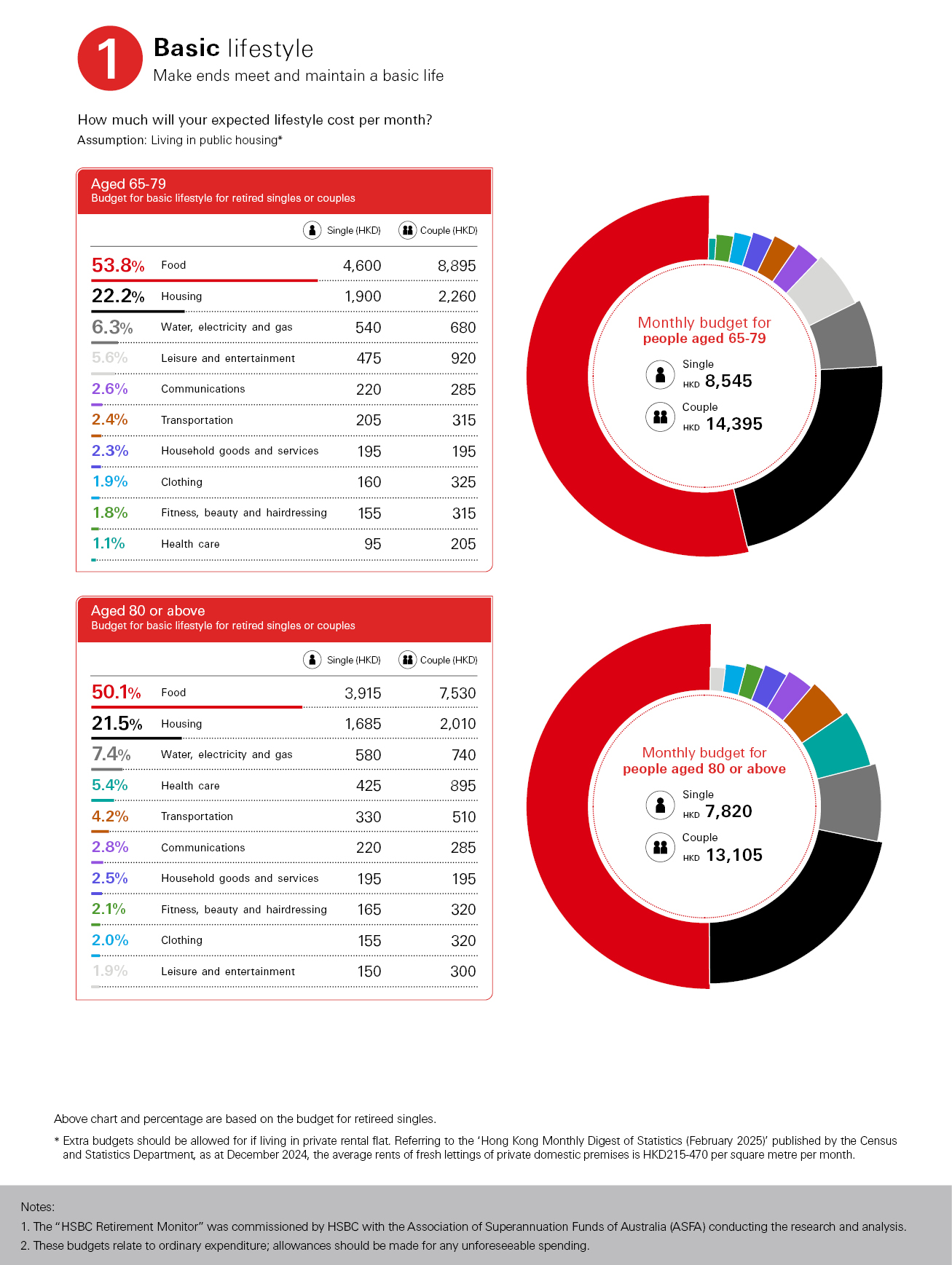

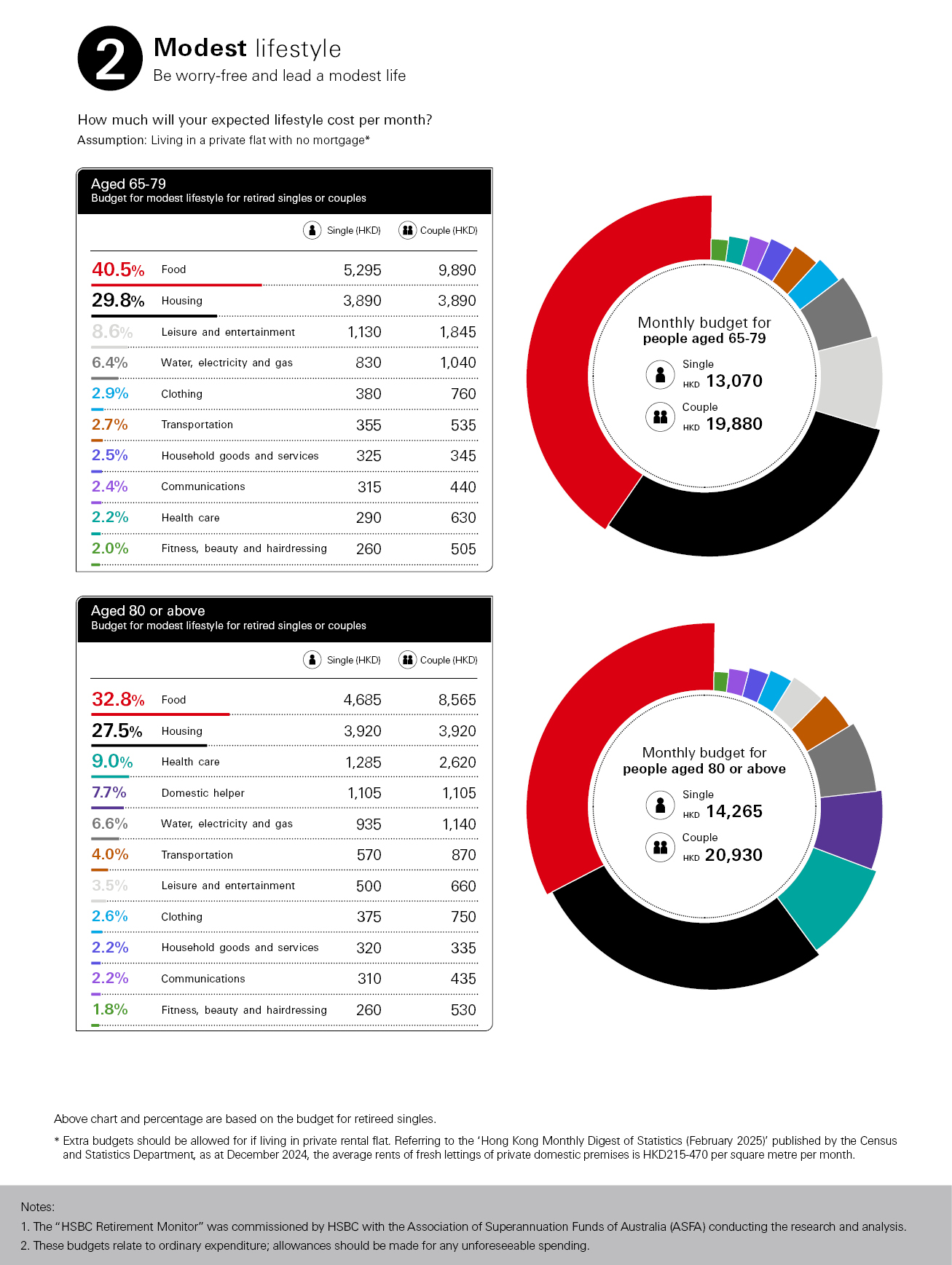

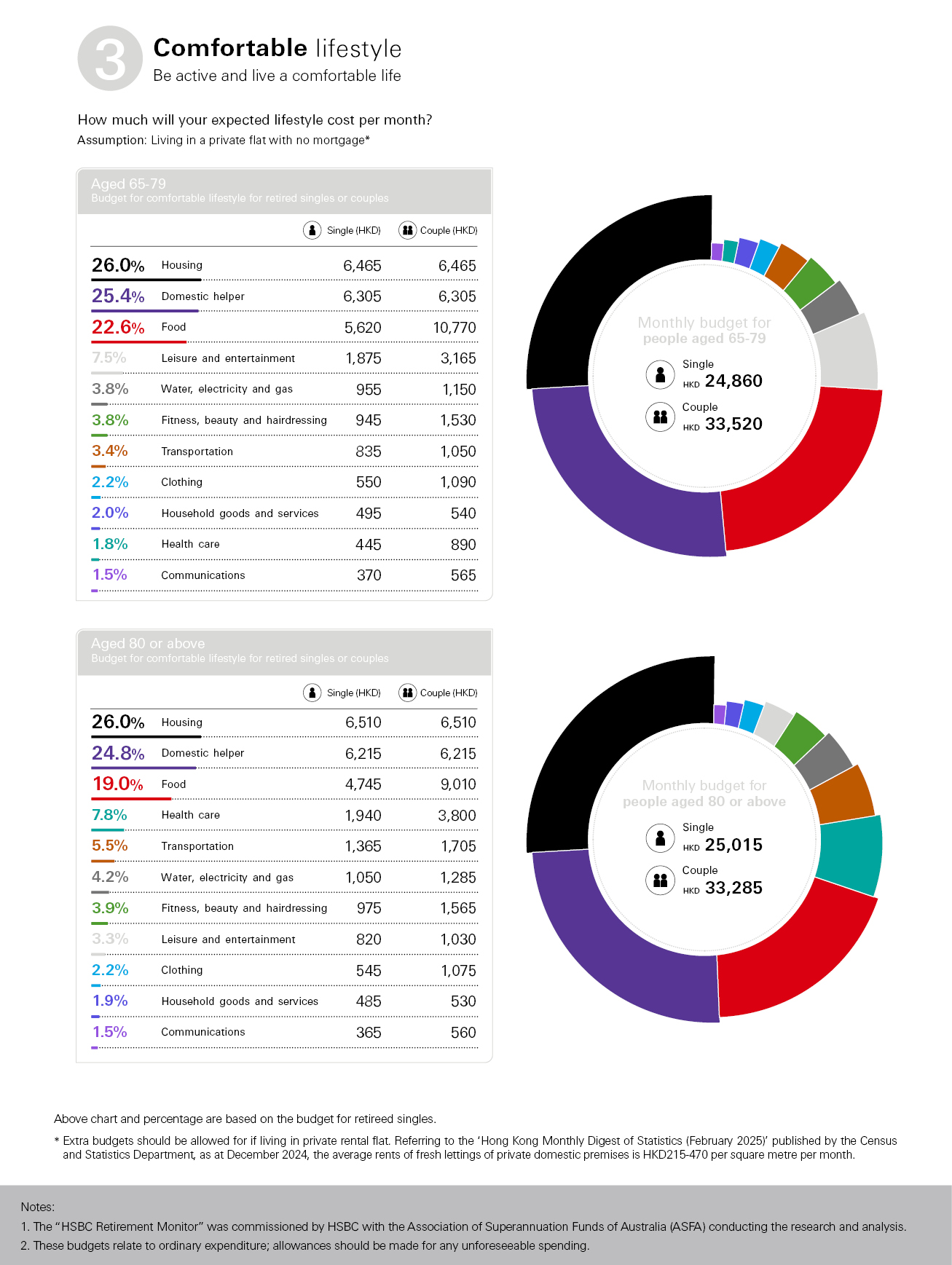

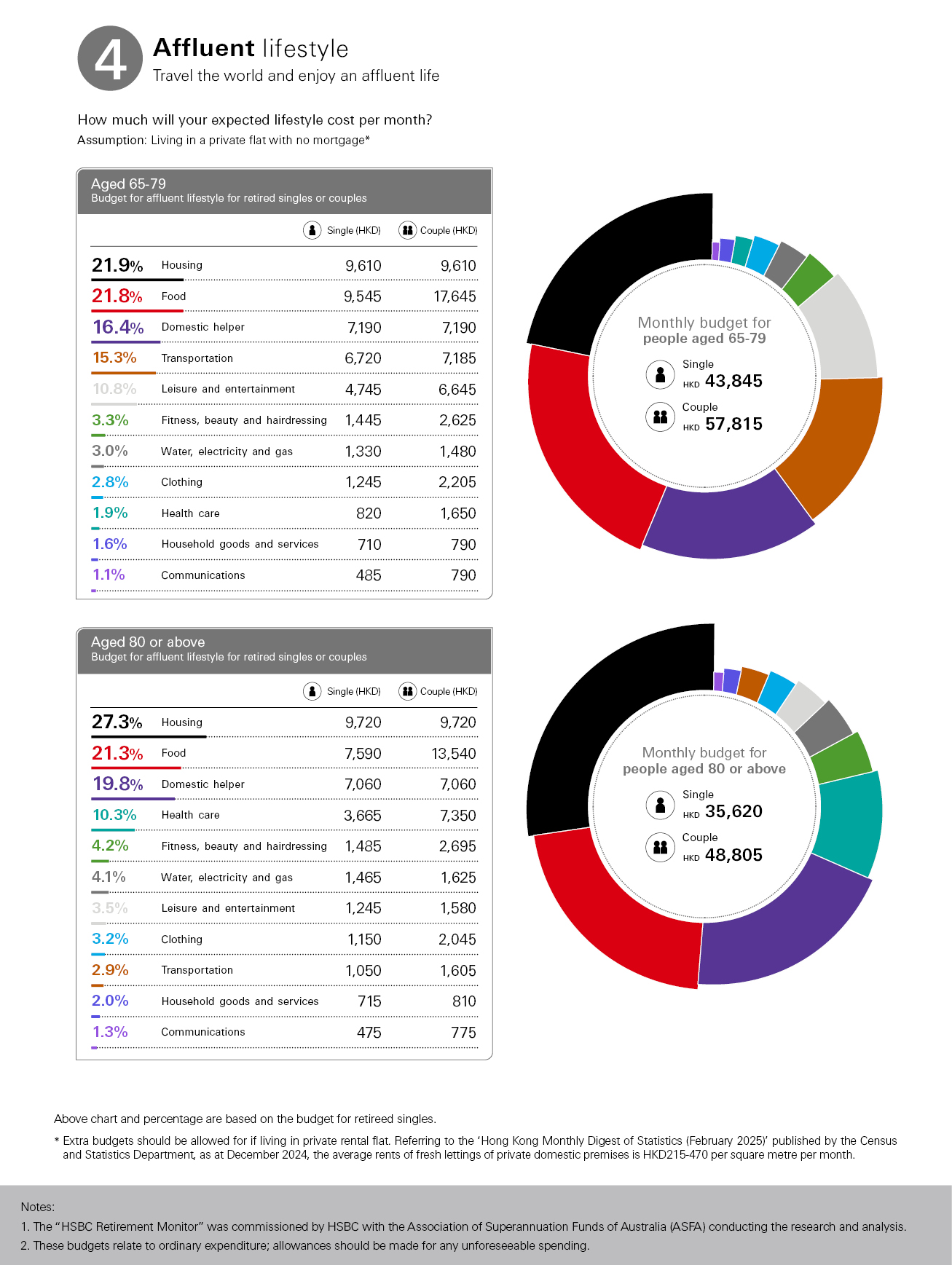

The HSBC Retirement Monitor provides an objective answer to this basic question: How much will I need to support my retirement life in Hong Kong? This will give you an idea of the monthly budget you will likely need to fund 4 different retirement lifestyles – basic, modest, comfortable or affluent.

The HSBC Retirement Monitor was commissioned by HSBC with The Association of Superannuation Funds of Australia (ASFA) conducting the research and analysis.

The budgets were put together through extensive research on the price of specific goods and services in Hong Kong and the spending patterns of Hong Kong retirees, together with the statistics from the Government of the HKSAR on the household expenditure for various income and age groups. The figures take into account recent price changes, as reflected in the Consumer Price Index published by the Census and Statistics Department.

The HSBC Retirement Monitor will be updated quarterly to reflect changes in the price of various goods and services and the subsequent changes in spending required by retirees.

While the budgets reflect typical costs and quantities purchased, specific individuals or couples will have different spending patterns. However, the overall figures and their breakdown will be a reference and may potentially assist you to formulate your own budget, because individuals can and do trade off spending in one area against another, and some retirees may have additional expenses, such as dependants.

The lifestyles chosen are not indications of relative wealth, but of spending patterns and habits. However, as a general guide, basic may be relevant to those in the lowest 25% of income distribution in retirement, while affluent may relate to the top 5%.

These budgets relate to ordinary expenditure; allowances should be made for any unforeseeable spending.

Latest report

The HSBC Retirement Monitor was commissioned by HSBC with The Association of Superannuation Funds of Australia (ASFA) conducting the research and analysis. It benchmarks the monthly budget needed to fund either a Basic, Modest, Comfortable or Affluent retirement lifestyle in Hong Kong. It is updated quarterly to reflect changes in the price of various goods and services and subsequent changes in spending required by retirees.

Retirement planning tools

Retirement planner

Find out if you have saved enough for your retirement.