What is HSBC GBA Wealth Management Connect?

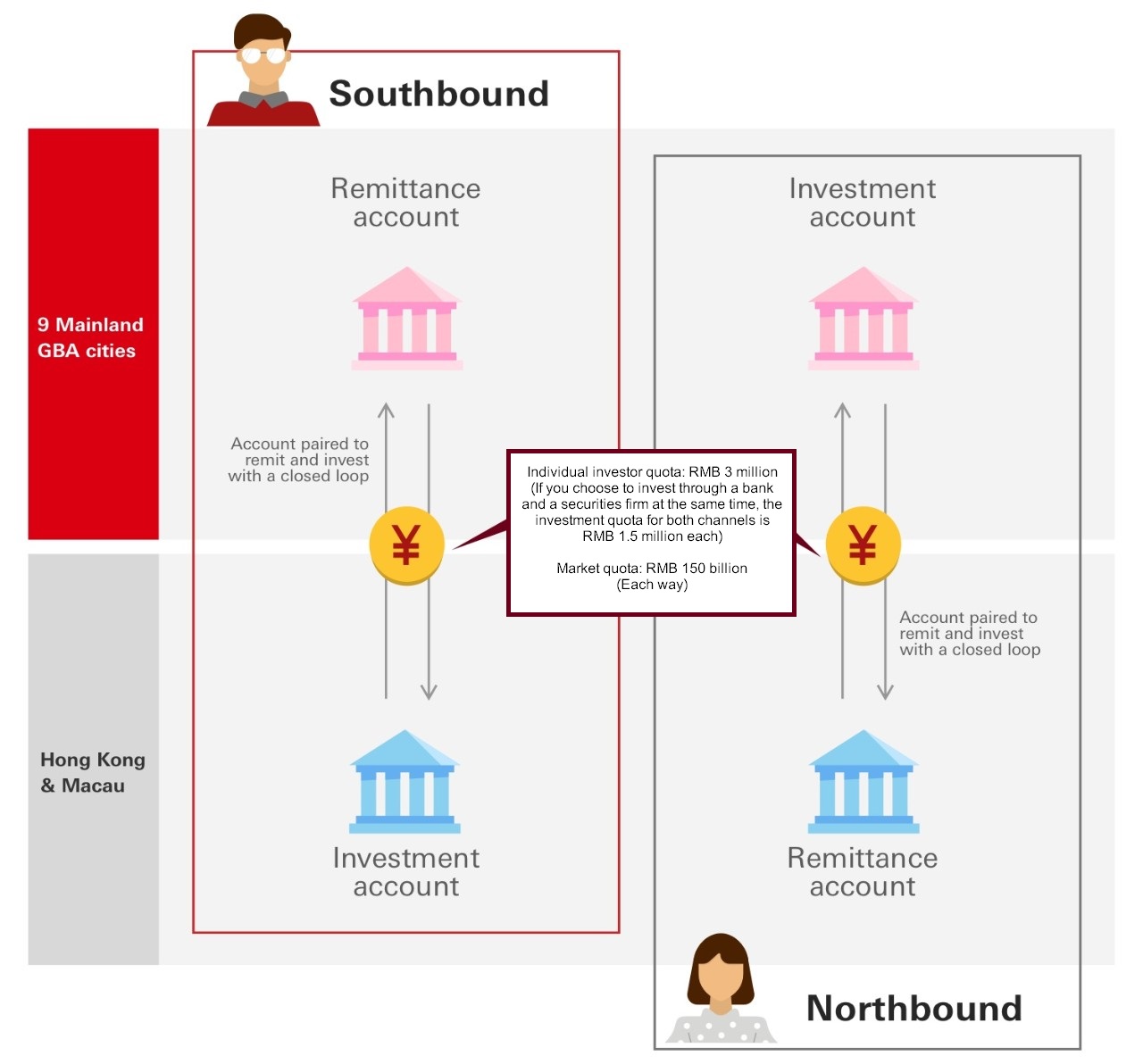

HSBC GBA Wealth Management Connect enables eligible residents in GBA cities2 across mainland China and Hong Kong to invest in wealth management products distributed by us and the mainland China cooperating banks via a closed-loop fund flow channel3.

Through HSBC GBA Wealth Management Connect:

- we and the mainland China cooperating banks have made available over 500 eligible wealth management products in the GBA

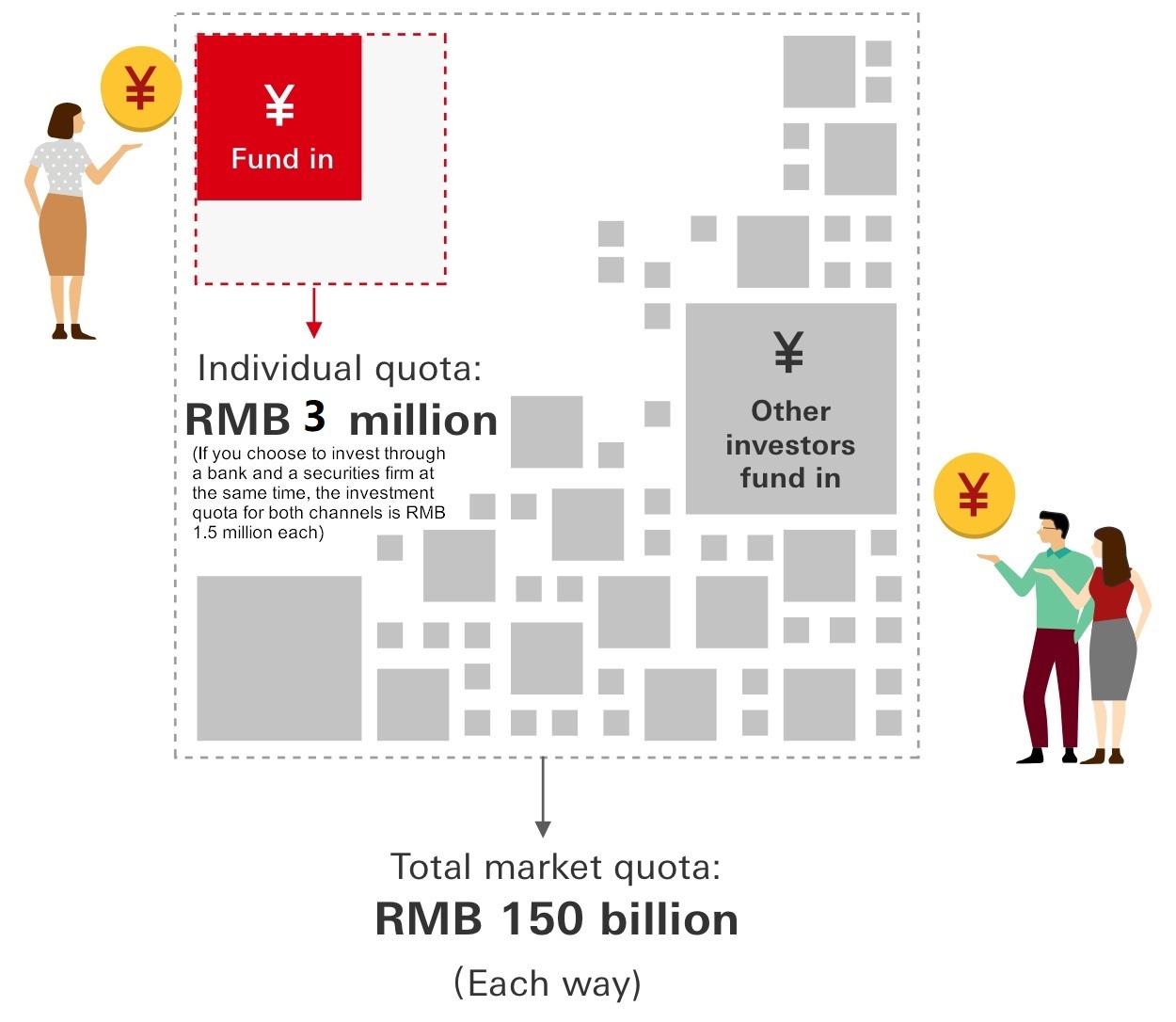

- you can invest up to an individual customer quota of RMB 3 million4 . If you choose to invest through a securities firm in addition to HSBC Greater Bay Area Wealth Management Connect, the investment quota allocated between the channels is RMB 1.5 million each. Subject to respective aggregate quotas5 of RMB150 billion for Southbound and Northbound services

Apply for an HSBC GBA Wealth Management Connect account to enjoy new limited-time offers

Offer 1: Get up to RMB800 in e-gift card coupon by joining our welcome offer and placing a bond subscription through your HSBC GBA WMC Southbound account.

Offer 2: Get an HSBC Special Edition Octopus Card (worth HKD100) and Godiva coupons (worth HKD400) by opening an HSBC GBA WMC Southbound account with a designated amount, and setting up financial planning at a designated Hong Kong branch.

Offer 3: Preferential Unit Trusts subscription charge of 0.9%.

Offer 4: As a HSBC GBA WMC Southbound customer, enjoy HSBC Premier's preferential interest rates when you place new fund time deposits.

Offer 5: As a HSBC GBA WMC Southbound or Northbound customer, enjoy a Below Balance Fee waiver for 12 months (worth HKD4,560) when you open an HSBC Premier account.

Investment involves risks. Terms and conditions apply. Learn more.

Your ticket to a world of opportunities in the Greater Bay Area

The path to success involves broadening your horizons and digging deeper for investment opportunities. Tapping into the new urbanisation and economic potential of the Greater Bay Area (GBA), we've partnered with HSBC China, Ping An Bank1 and Industrial Bank Co., Ltd to provide HSBC GBA Wealth Management Connect Services ("HSBC GBA Wealth Connect") services to you. HSBC GBA Wealth Connect is geared at helping you achieve your wealth goals through an enhanced cross-border wealth management solution, all aimed at expanding your investment opportunities across the GBA.

Features

Effortlessly manage your cross-border transactions with HSBC GBA Wealth Connect.

Take your investments to the next level with these features:

- Diversified investment products

- Convenient 24/7 digital access to HSBC GBA Wealth Connect

- Access to GBA Wealth Management Connect Centres across the GBA

- Zero remittance fee for cross-border fund remittances7

- Wealth insights and solutions

Connecting you to a wealth of investment opportunities

Northbound services

Our Northbound services allow eligible residents in Hong Kong to invest in wealth management products distributed by the mainland China cooperating banks via designated channels. Cross-border fund remittances and transfers will be handled by HSBC Hong Kong.

Northbound services eligible products:

- Local Unit Trusts ranging from bond to balanced funds and money market funds

- Public fixed income wealth management products

Northbound wealth management products are delivered and managed by third party product providers. Under no circumstances will the mainland China cooperating banks be liable for the responsibilities of investment, redemption, and risk management.

Please note investment products offered by the mainland China cooperating banks under Northbound services have not been authorised by the Securities and Futures Commission (SFC) and the relevant offering documents have not been examined by the SFC.

Learn more about HSBC GBA Wealth Connect from HSBC China, our mainland partner bank.

Learn more about HSBC GBA Wealth Connect from Ping An Bank, our mainland partner bank.

Learn more about HSBC GBA Wealth Connect from Industrial Bank Co., Ltd, our mainland partner bank.

Southbound services

Our Southbound services allow eligible residents in GBA cities in mainland China to invest in over 200 wealth management products distributed by HSBC Hong Kong via designated channels. Cross-boundary funds remittances and transfers will be handled by the mainland China cooperating bank.

Southbound services eligible products6:

- Unit Trusts: Over 30 Unit Trust products, supporting 160 share classes, 10 currencies, and covering funds type ranging from balanced, bond and money market funds

- Bonds: Over 50 bonds, covering both corporate bonds and government bonds

- Deposits: 11 currencies, including HKD, USD, RMB, AUD, CAD, CHF, EUR, JPY, GBP, NZD, and SGD.

How to get started with HSBC GBA Wealth Connect services

Recognised with various awards in the Greater Bay Area

We've deep roots in Hong Kong, a strong China franchise, and a wide global network. Our innovative cross-border solutions have helped us serve as your bridge between markets. We're honoured to have been selected as Excellence Performance for GBA Banking Sector - Cross border wealth management (Personal) 2025 by Bloomberg Businessweek, Best International Bank for GBA 2024 by Euromoney, and Bank of the Year & ESG Sustainability of the Year for GBA 2024 by Bloomberg Businessweek.

Bloomberg Businessweek Cross border wealth management (Personal) for GBA 2025

Euromoney Best International Bank for Greater Bay Area (GBA) 2024

Bloomberg Businessweek Bank of the Year for GBA 2024

Bloomberg Businessweek ESG Sustainability of the Year for GBA 2024

Ming Pao Award for Excellence in Wealth Planning Strategy (Premier Banking Service) 2025

Ming Pao Greater Bay Area Award for Excellence in Cross-Border Banking Product 2025

Contact us

Calling from mainland China: 400-842-7699

Explore other GBA opportunities

Important information

Remarks:

- HSBC Bank (China) Company Limited ("HSBC China"), Ping An Bank Co., Ltd ("Ping An Bank") and Industrial Bank Co., Ltd are our cooperating banks in mainland China for HSBC GBA Wealth Management Connect Services. HSBC China, Ping An Bank and Industrial Bank Co., Ltd are not authorised institutions as defined in the Hong Kong Banking Ordinance and are not subject to the supervision of the Hong Kong Monetary Authority. HSBC China, Ping An Bank and Industrial Bank Co., Ltd cannot carry on any banking business or business of taking deposits in Hong Kong. Any deposits maintained with HSBC China, Ping An Bank and Industrial Bank Co., Ltd are not protected under the Deposit Protection Scheme in Hong Kong.

- The 9 Greater Bay Area cities within mainland China refer to Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing.

- Under the HSBC GBA Wealth Connect services, cross-border remittance must be conducted between the paired dedicated investment and remittance accounts maintained with us and the mainland China cooperating bank.

- The usage of individual investor quota subject to a cap of RMB 3 million and is calculated as follows:

a. Usage of individual investor quota under the Southbound services = cumulative remittances from mainland China to Hong Kong and Macao under the Southbound services – cumulative remittances from Hong Kong and Macao back to mainland China under the Southbound services

b. Usage of individual investor quota under the Northbound services = cumulative remittances to mainland China under the Northbound services – cumulative remittances from mainland China under the Northbound services - We will check the usage of the aggregate quota before accepting remittances to ensure that the net remittance under the Northbound services or Southbound services does not exceed the relevant aggregate quota. Instructions for remittances from the mainland China to Hong Kong under the Southbound services or from Hong Kong to mainland China under the Northbound services may be put on hold as a result of the relevant aggregate quota being used up.

- Unless otherwise specified or promotional offer is applicable, eligible product transactions under Southbound services placed using GBA Wealth Connect account are subject to HSBC One fees and charges.

- HSBC imposes HKD0 handling fees on customers who transfer money between mainland China and Hong Kong for investing in products under the HSBC GBA Wealth Connect via online and mobile banking between the paired accounts. The remittance service is subject to intermediary bank charge. For details of remittance fees charged by our mainland China cooperating banks, please visit the public website of our mainland China cooperating banks for details.

- Vulnerable customer refers to a customer whose ability to understand the associated risks of his/her investment and withstand the potential losses of the investment is limited. In determining whether a customer is a vulnerable customer, banks will take a holistic view of the circumstances of the customer, including the level of financial sophistication (e.g. investment experience), the state of mind (e.g. ability to make investment decision) and the level of wealth.

- Full civil capacity refers to an individual aged 18 or above who is able to fully account for their own conduct.