Trade stocks the easy way

Key benefits

3 major markets at your fingertips

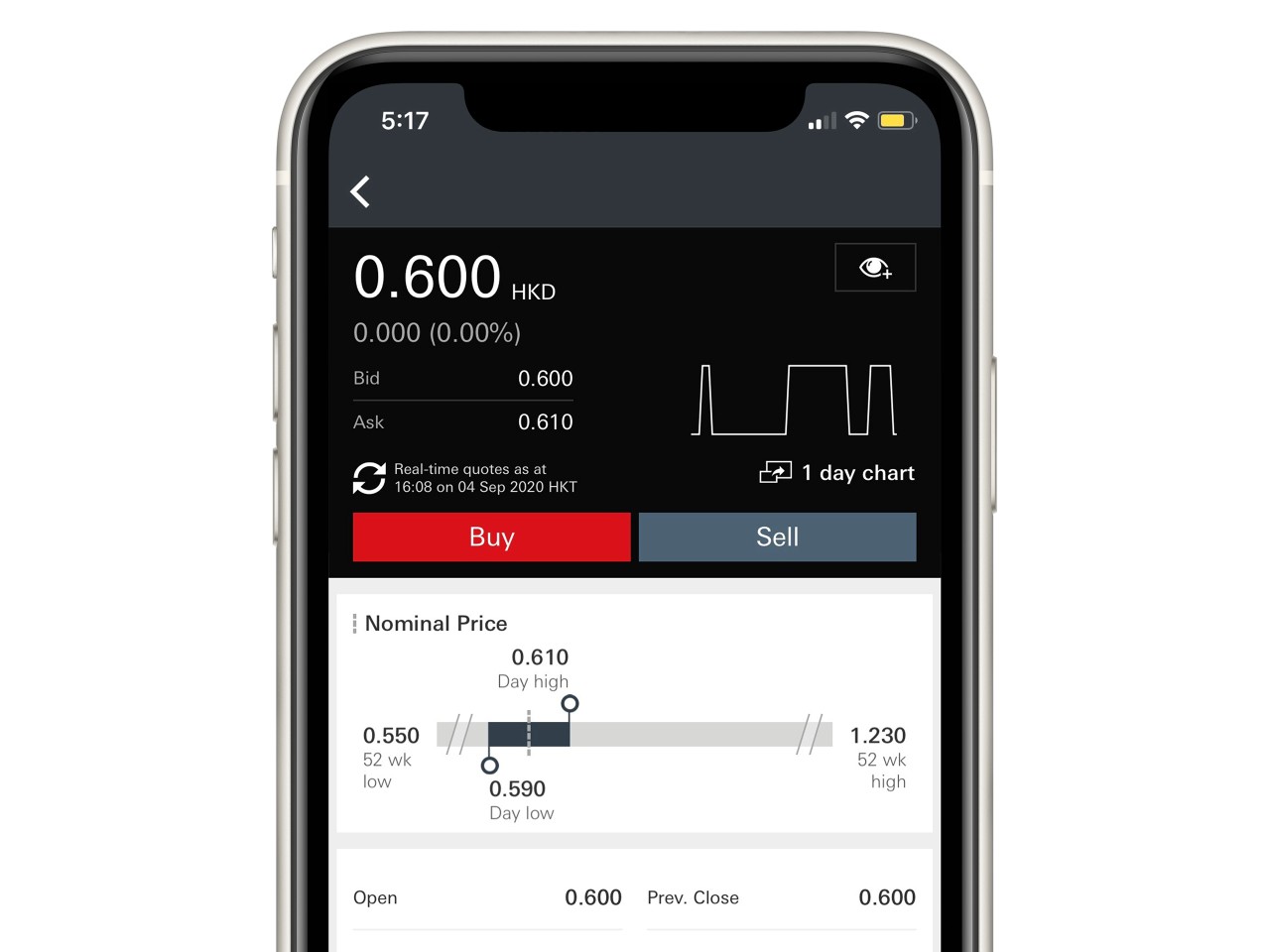

Keep up with important market events. Get free real-time data on 3 major stock markets (Hong Kong, US and China A) and set up stock price alerts for your favourite stocks.

Make informed trades instantly

Access a variety of tools designed to help you decide your next move and learn about capital inflows, outflows and order sizes. Trade and place orders instantly in just a few taps.

Keep your portfolio secure

Your portfolio is kept safe with strong data encryption and secure log on methods such as mobile security key and biometric authentication, Stay alert with SMS or email notifications after every order execution, cancellation or expiry.

Why get the HSBC HK Easy Invest app

Make quick but informed decisions

Powerful tools that help you dig deep and gather insights

- Check out technical analysis indicators, chart patterns and market consensus of HK stocks through the Stock Insights feature

- Choose from a suite of technical analysis tools such as Bollinger Bands, Moving Average Convergence/Divergence (MACD) and Relative Strength Index (RSI)

- Learn more about the capital inflows, outflows and order sizes – no matter if they're small, medium or large

- Find out more about the best 10 bid and ask orders, and their broker information with our Level 2 stock quotation services*

*Available for HSBC Jade and Premier customers only.

HSBC's exclusive social trading - HSBC TradeTrack

Check out stock market data before you log on and see the big picture of HSBC top trading trends

- Check out the top 10 stocks our top 5% performing personal banking investors are buying, selling and holding

- Learn more about the top 10 stocks other HSBC personal banking investors are actively trading

Join HSBC Trade25 or HSBC Top Trader Club

Opt in for rewards and lower brokerage fees

- Young investors aged 18 to 25 can trade up to HKD250,000 a month at a flat monthly fee of HKD25 with HSBC Trade25

- Join HSBC Top Trader Club to enjoy volume-based brokerage fees—the more you trade, the lower your brokerage fees, plus get 10% p.a. on your uninvested cash

To enjoy the 1-month HKD time deposit rewards, customers need to make at least 1 trade per month. The current preferential 1-month time deposit rate is 5% p.a. (which will be applied to the trades executed in December 2022) and starting from February 2023, the preferential 1-month time deposit rate will be changed into 10% p.a. (which will be applied to the trades executed from January 2022 onwards). Interest rates are not guaranteed and may be subject to change as per prevailing market conditions.

Stay on the market's pulse

Get all the latest market information and news

- Set up personalised alerts for your favourite stocks and stay on top of important market events

- Check out performance across market sectors at a glance

- Stay up to date with the Hong Kong, US and China A markets, World Indices and top market movers

- Tailor the news you see to your needs and your portfolio

- Quickly locate the best HK/US ETFs for you via ETF screener

Download the HSBC HK Easy Invest app now

Select the app store for your mobile device to download the app. Or simply scan the QR code to get the app and start investing the easy way.

Need help?

Talk with us

Find your nearest branch or call us on (852) 2233 3733.

Lines are open 9:00am to 6:00pm, Mondays to Fridays, and 9:00am to 1:00pm on Saturdays, except public holidays.

Or reach us via LiveChat.

Or place an order by phone

Our stock order placement hotlines are open 8:00am to 4:10pm, Mondays to Fridays.

HSBC Jade customers: (852) 2233 3033

HSBC Premier customers: (852) 2996 6822

HSBC One customers: (852) 2996 6833

HSBC Personal Integrated Banking: (852) 2233 3000

Find out more

You may also interested in

HSBC Trade25

$0 commission stock trading for just HKD25 a month.

HSBC Top Trader Club

Brokerage fees as low as 0.01% and 10% p.a. HKD time deposit rates all year round.

Initial Public Offerings (IPOs)

Get access first to new IPOs and invest in the future. You can subscribe to the newest stock and bond IPOs in a variety of ways through HSBC.

Securities Margin Trading service

Increase your buying power with additional investment capital to create higher potential returns.