Diversify with as little as HKD100

We make it easy to invest in all assets and markets, by covering a wide range of companies, sectors and regions. With our selected funds, you can capture an entire index or invest in a whole portfolio that suits your risk appetite.

Key benefits

Exclusive cash reward for new and returning customers

Discover the latest FlexInvest offers.

Fees and charges

You'll be charged:

- a monthly platform fee, but only when your average holding balance (the daily average of the total market value of your holdings) reaches HKD10,000. See the table for how much you might need to pay.

You won't be charged:

- any fund management fees by us, as the companies who manage the funds will take them directly from the fund's performance (read the fund detail pages for details of these fees)

- for any trading activities—you can buy or sell FlexInvest funds for free, without any limits

Fees table

| Your average holding balance | Monthly platform fees |

|---|---|

| Less than HKD10,000 | Free |

| Between HKD10,000–200,000 |

HKD28 per month |

| More than HKD200,000 |

0.8% p.a. of your average holding balance |

| Your average holding balance | Less than HKD10,000 |

|---|---|

| Monthly platform fees |

Free |

| Your average holding balance |

Between HKD10,000–200,000 |

| Monthly platform fees |

HKD28 per month |

| Your average holding balance |

More than HKD200,000 |

| Monthly platform fees |

0.8% p.a. of your average holding balance |

Fund types you can invest in with HSBC FlexInvest

Money market funds

Money market funds let you invest in low-risk financial products like cash or short-term debt. They are generally considered one of the least risky investments available.

Bond index funds

Bonds are a special kind of debt issued by companies or governments. They're deemed conservative investments with lower risks and returns than equities. But they can be vital to a diversified portfolio.

You can explore bond index funds in FlexInvest by region or industry.

Equity index funds

Equity index funds let you invest in a portfolio of multiple companies. These funds generally carry higher risks than bond index funds. But they can be essential to a diversified portfolio.

Choose from 5 different equity index funds, each consisting of a broad selection of company stocks that aims to replicate an entire index and its composition—for example, Hang Seng Index or S&P 500 Net Total Return Index.

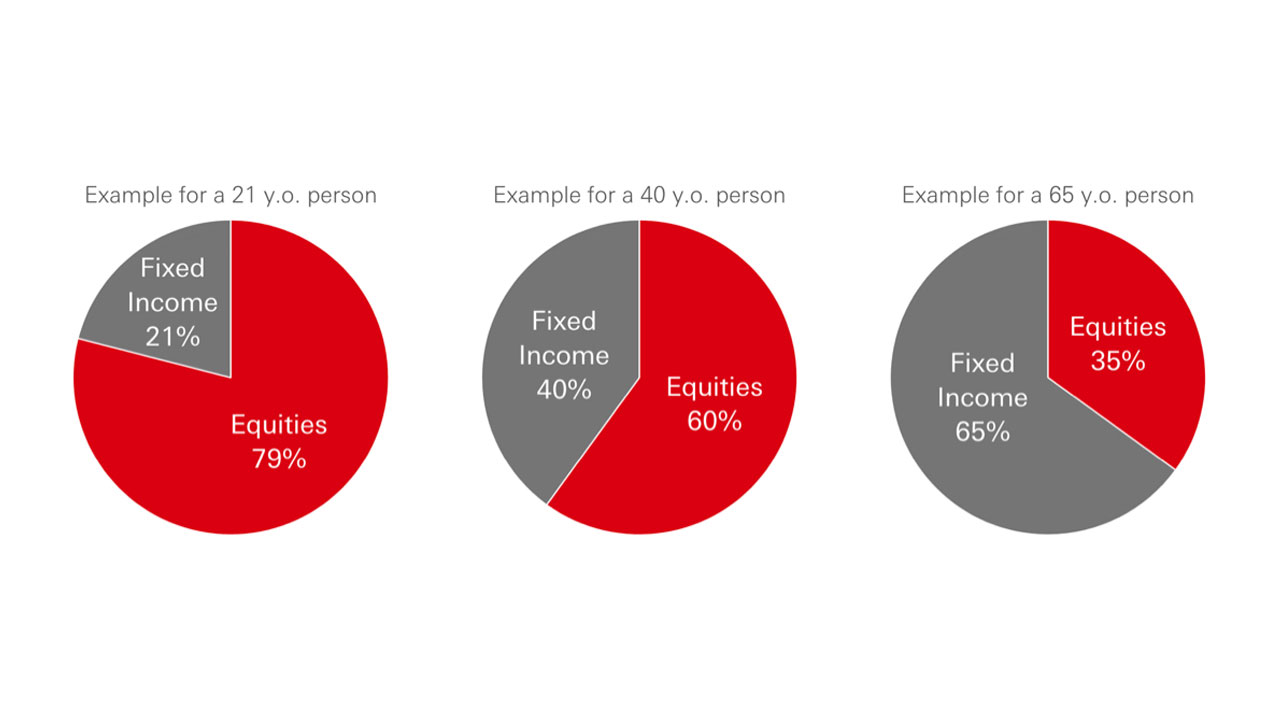

Multi-asset funds

Our World Selection portfolios let you invest within your risk appetite easily. A suite of 5 multi-asset instruments, they're designed and managed within their specific risk level. They can include bonds, equities, money market funds and more.

An award-winning platform

FlexInvest won the top prize for a Wealth Management Platform for 3 consecutive years at the Bloomberg Businessweek Financial Institution Awards, in 2020, 2021 and 2022.

Get started

To get started, you'll need to open an investment account and fill in a valid Risk Profiling Questionnaire. You can do both of these on the HSBC HK Mobile Banking app.

If you don't have an HSBC account yet, you can download the app to open yours easily.

To open an account via the app, you must:

- be a permanent resident aged 18 to 64 residing in Hong Kong

- not have any existing HSBC bank or investment accounts, or credit cards

Join HSBC Flexinvest in just 3 steps

Step 1

Log on to the HSBC HK Mobile Banking app

Step 2

Select 'Wealth', then 'FlexInvest'.

Step 3

You can refer to our FlexInvest user guide for more information on how to place an order and manage your holdings.

Need help?

Talk to us

You can reach us via Live Chat.

Don't have an HSBC investment account?

You can open an investment account on the HSBC HK Mobile Banking app and start trading with us in minutes.

Find out more

You may also be interested in

FlexInvest funds list

A flexible way to invest in funds according to your risk appetite

Unit trusts

Invest in a diversified portfolio to achieve your financial goals

Learn to invest in 7 days

If you want to learn more about investing and options to consider, you can sign up for our free 7-day email course—perfect for beginners.

Take our Risk Profiling Questionnaire

How much risk are you comfortable with? Take or retake our Risk Profiling Questionnaire (RPQ) to get your risk rating score and see which funds might suit you.