Bolster your investment portfolio

Are you looking for information on investing for beginners or are you building a sophisticated investment portfolio? This guide uses our hybrid and online wealth services and products to help you navigate all the steps in the process - from how to start investing through to rebalancing your portfolio.

5 steps to start your investment journey

Understand key procedures such as opening an investment account before you start investing with HSBC.

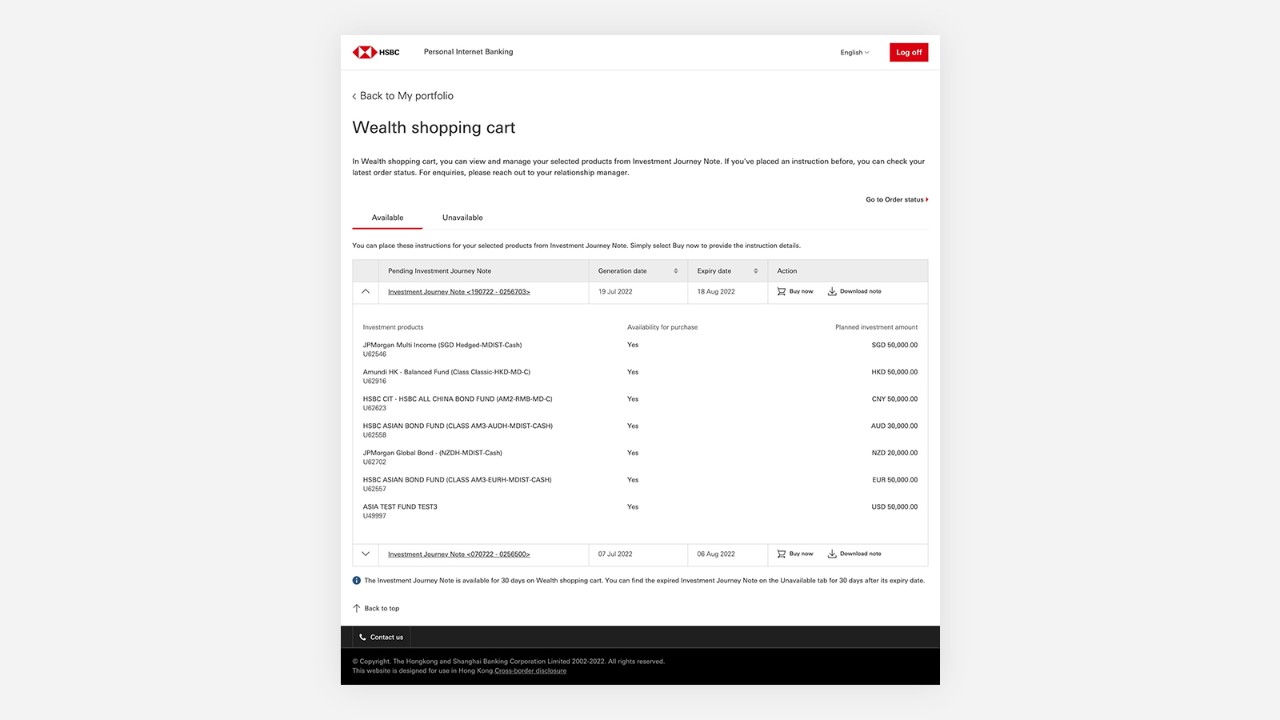

Consider options to help you create a balanced portfolio.

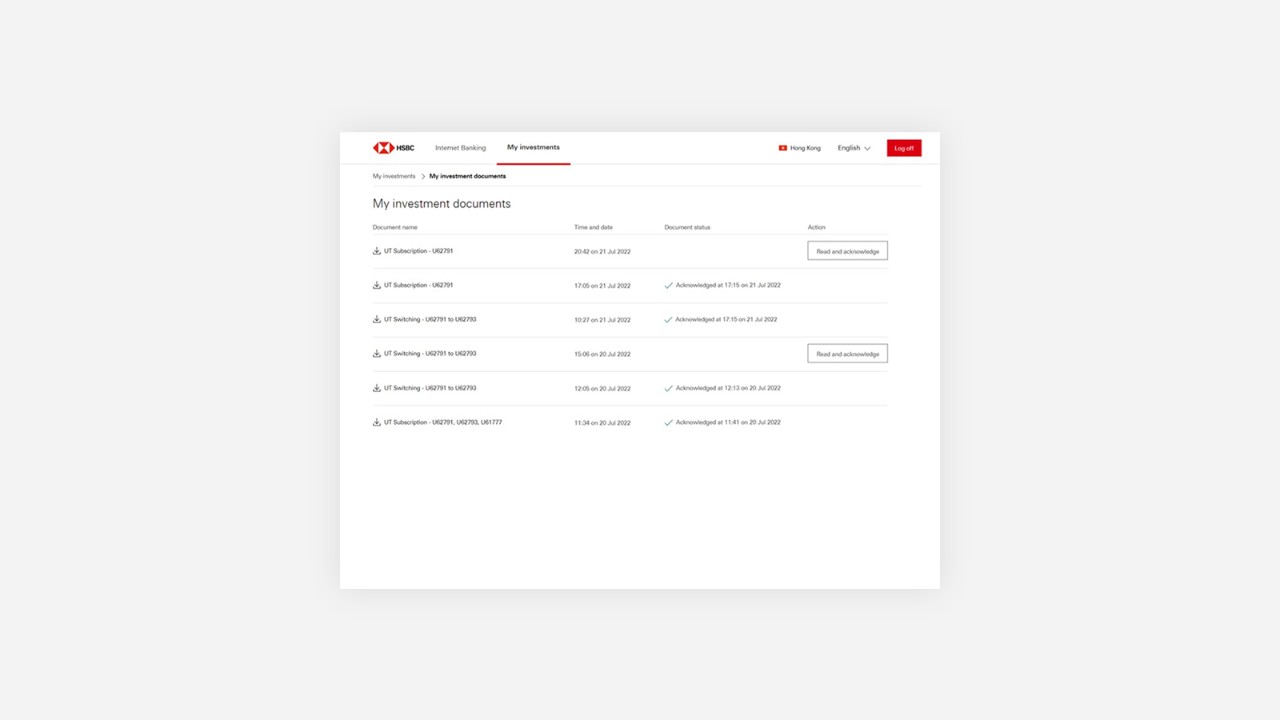

Read the detailed guides on our product features and application options.

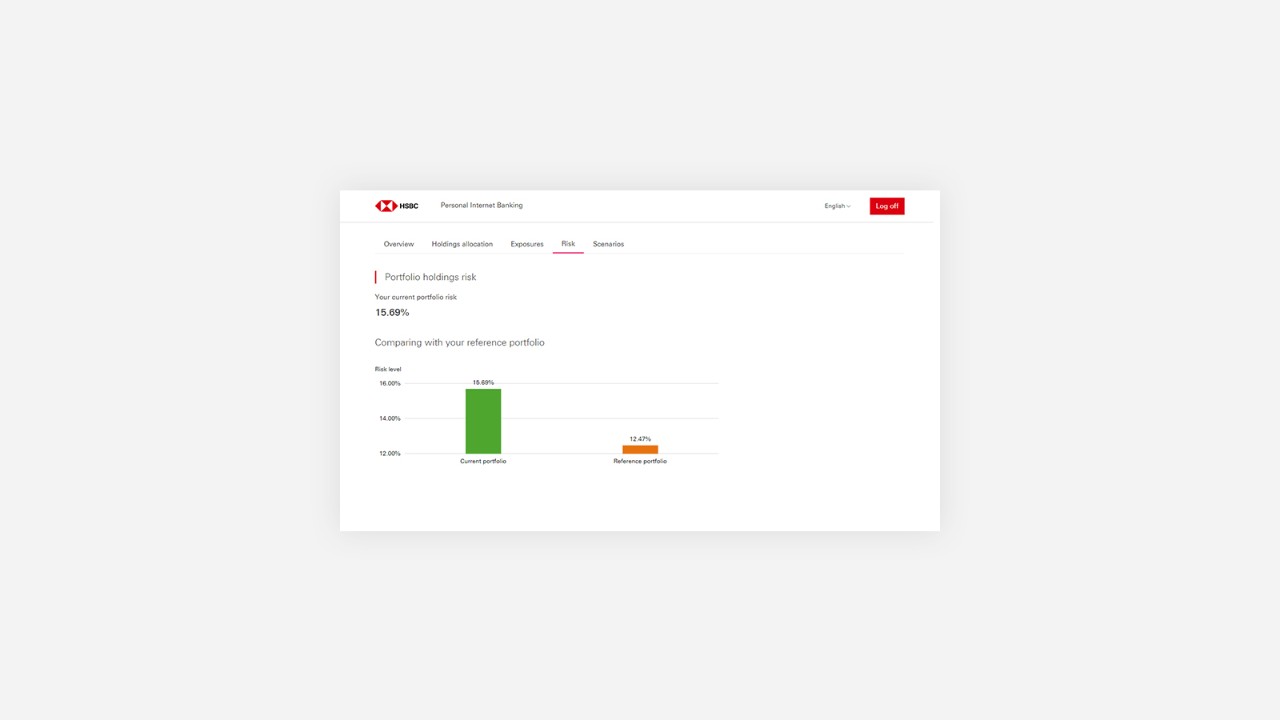

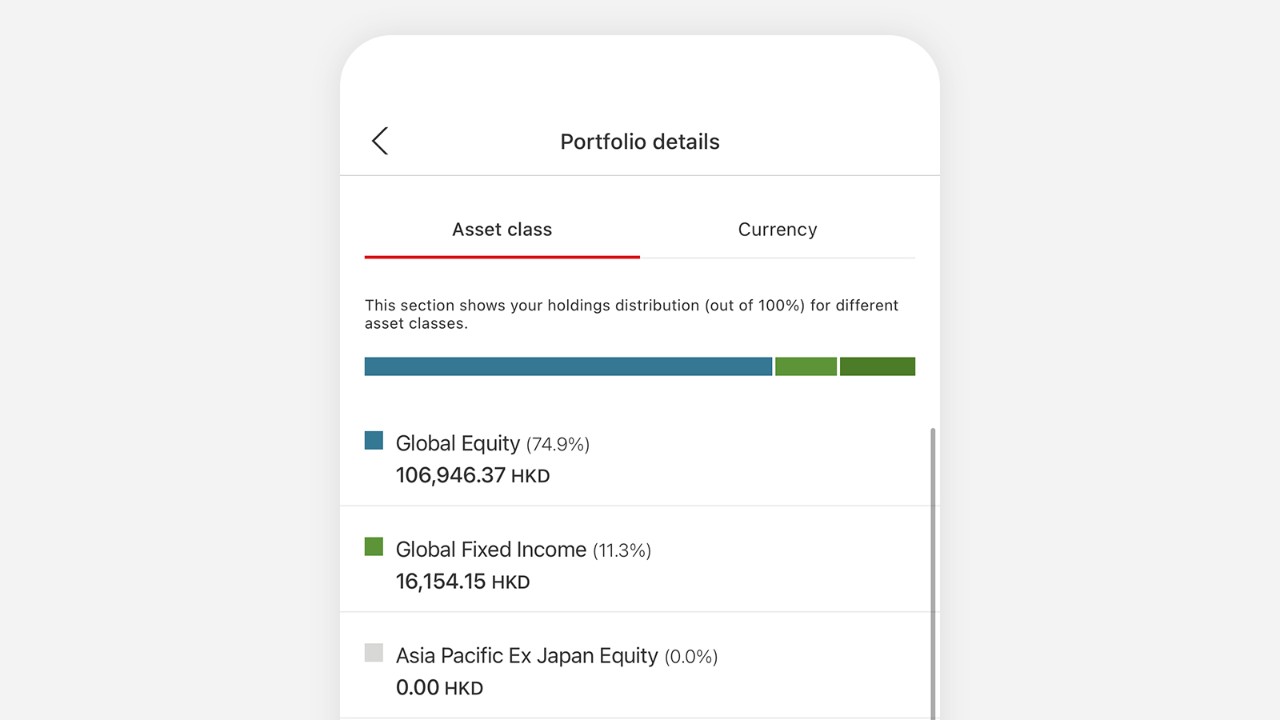

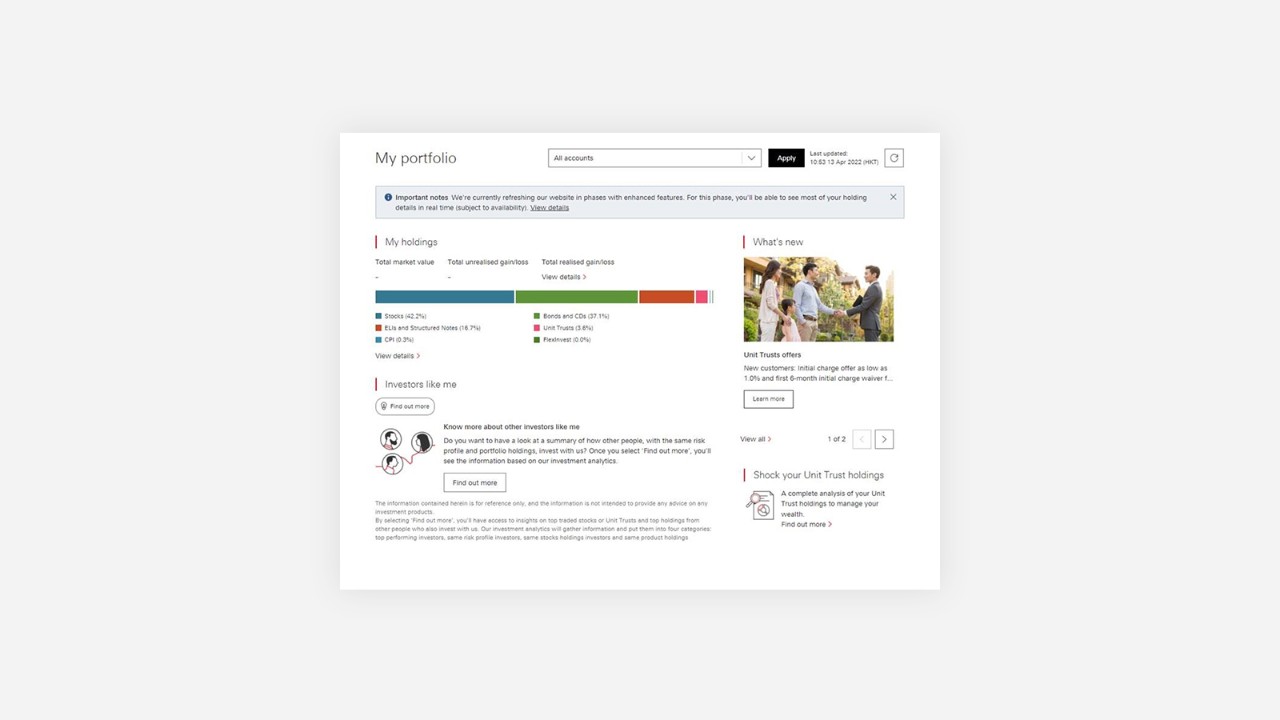

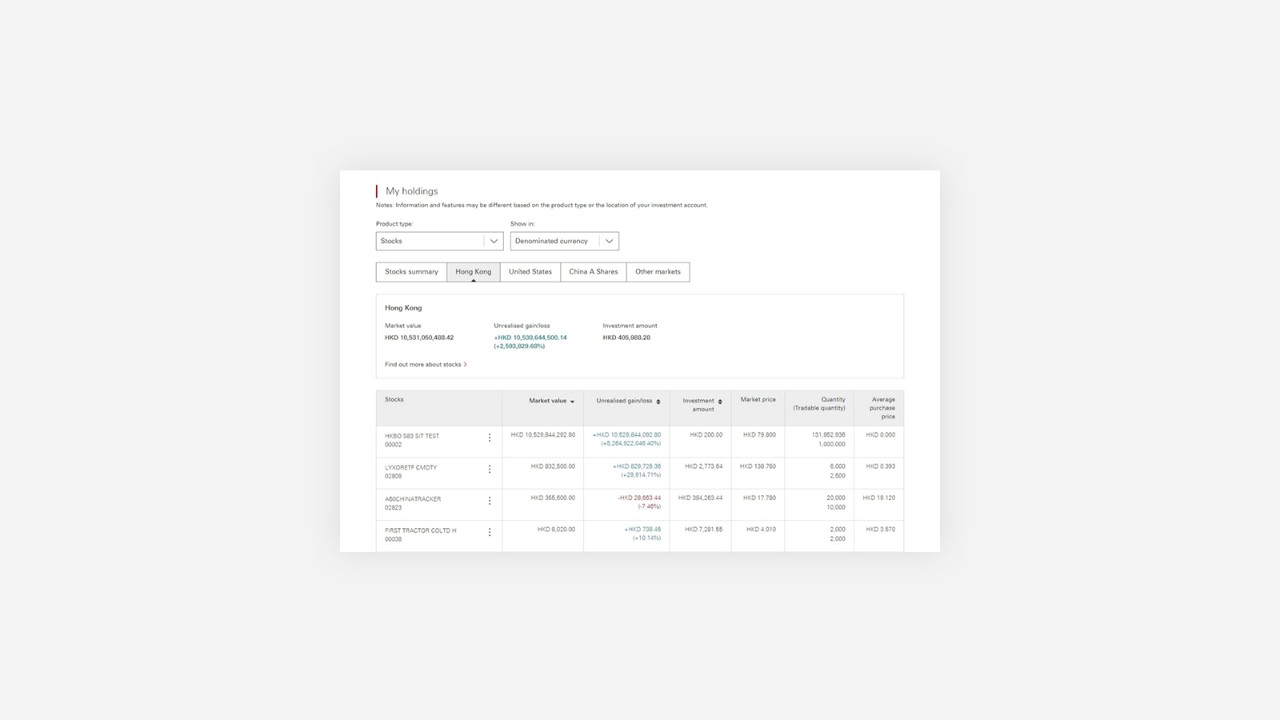

Get expert insights from our portfolio analysis tool, or an overview of your holdings using our wealth dashboard.

Use our platform to review how your investments are performing and what other customers like you have invested in.

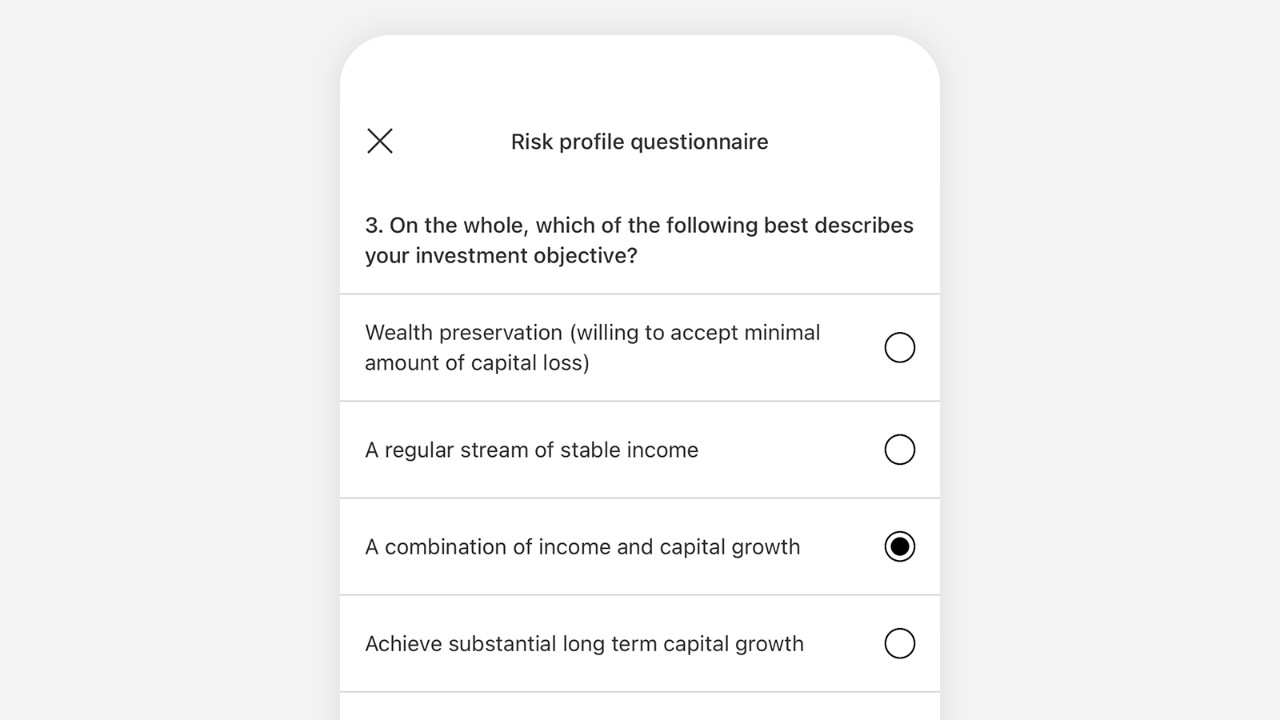

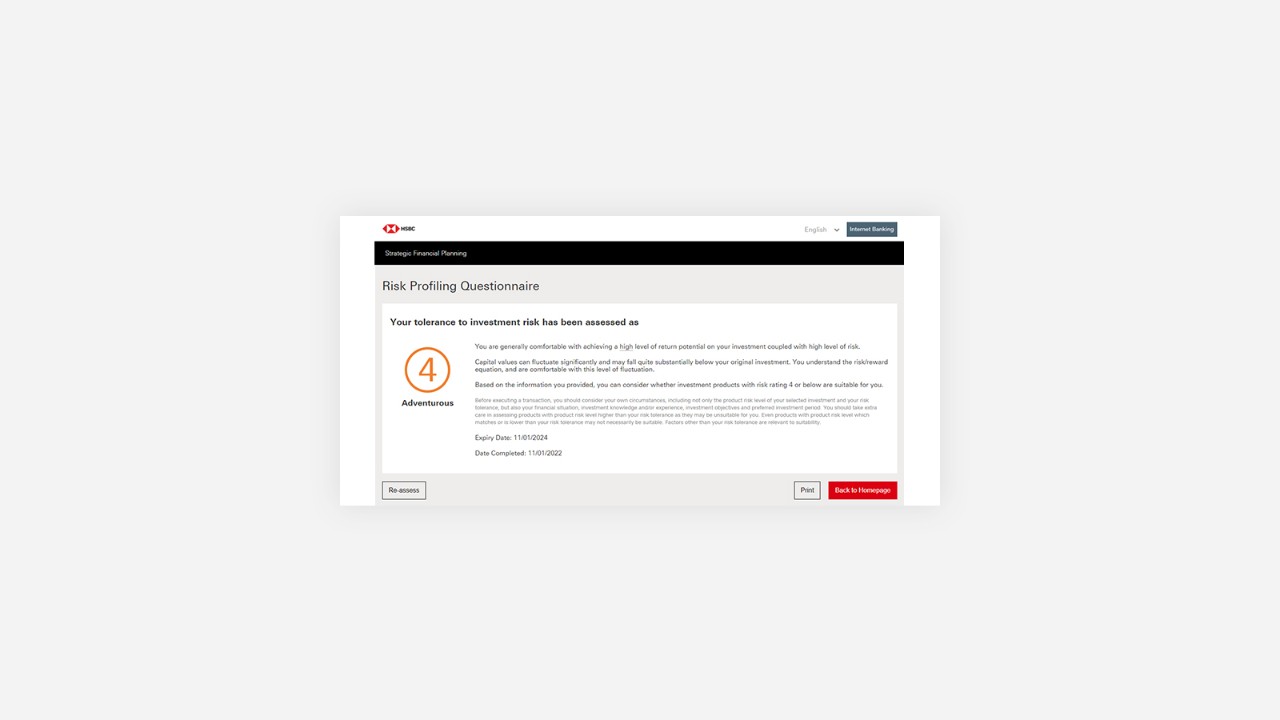

Step 1: Prepare yourself before investing

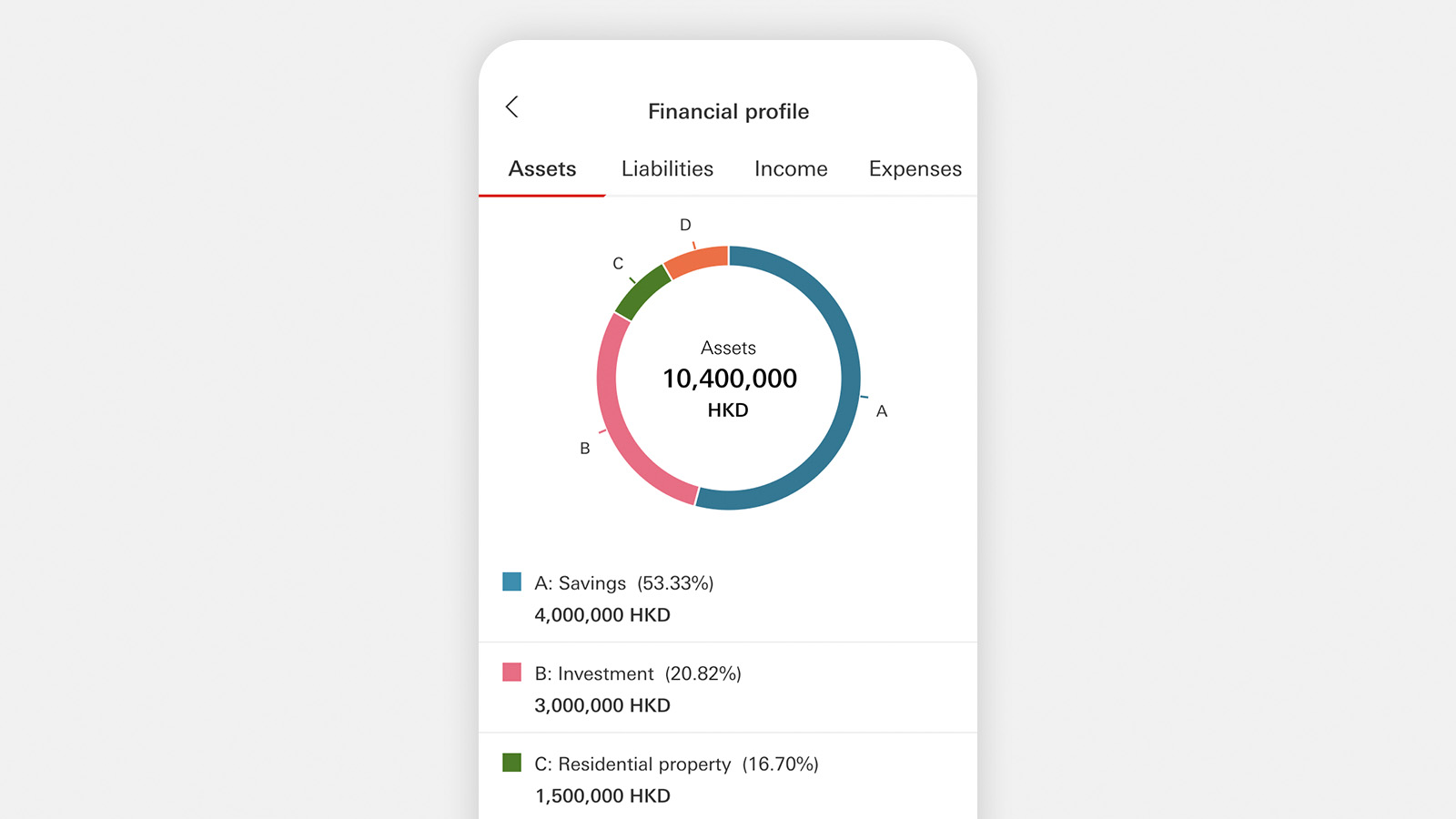

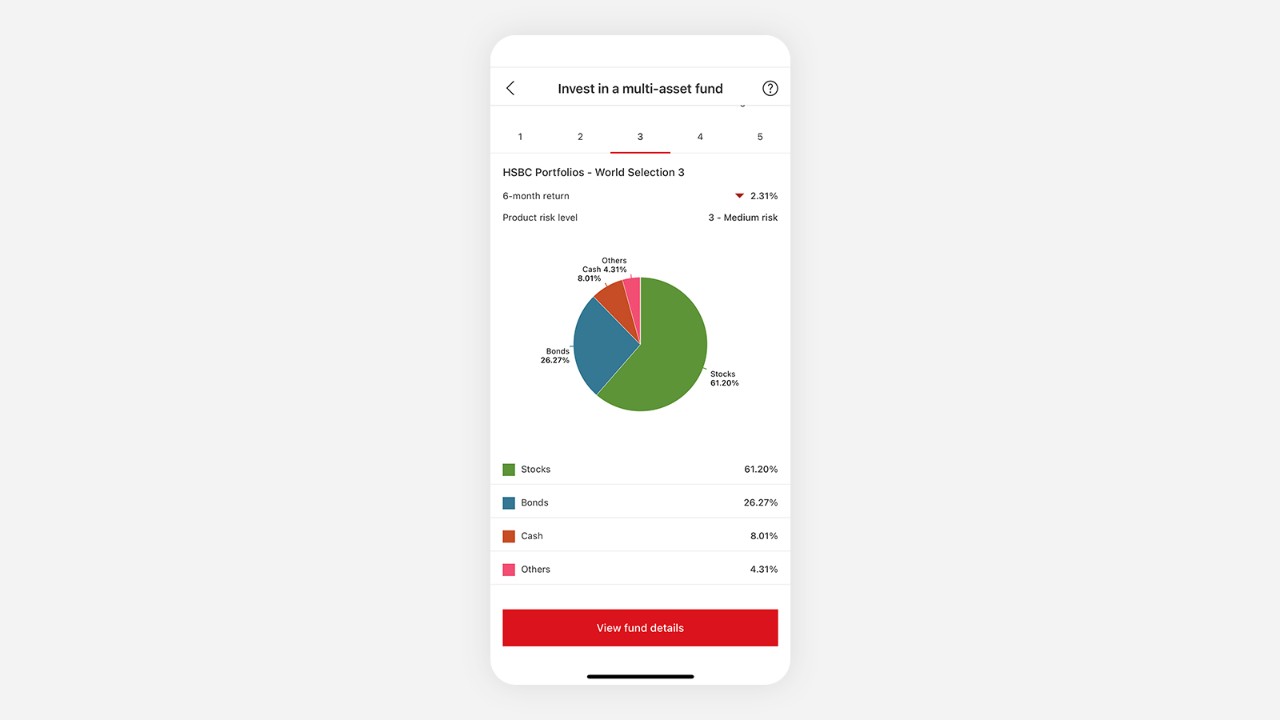

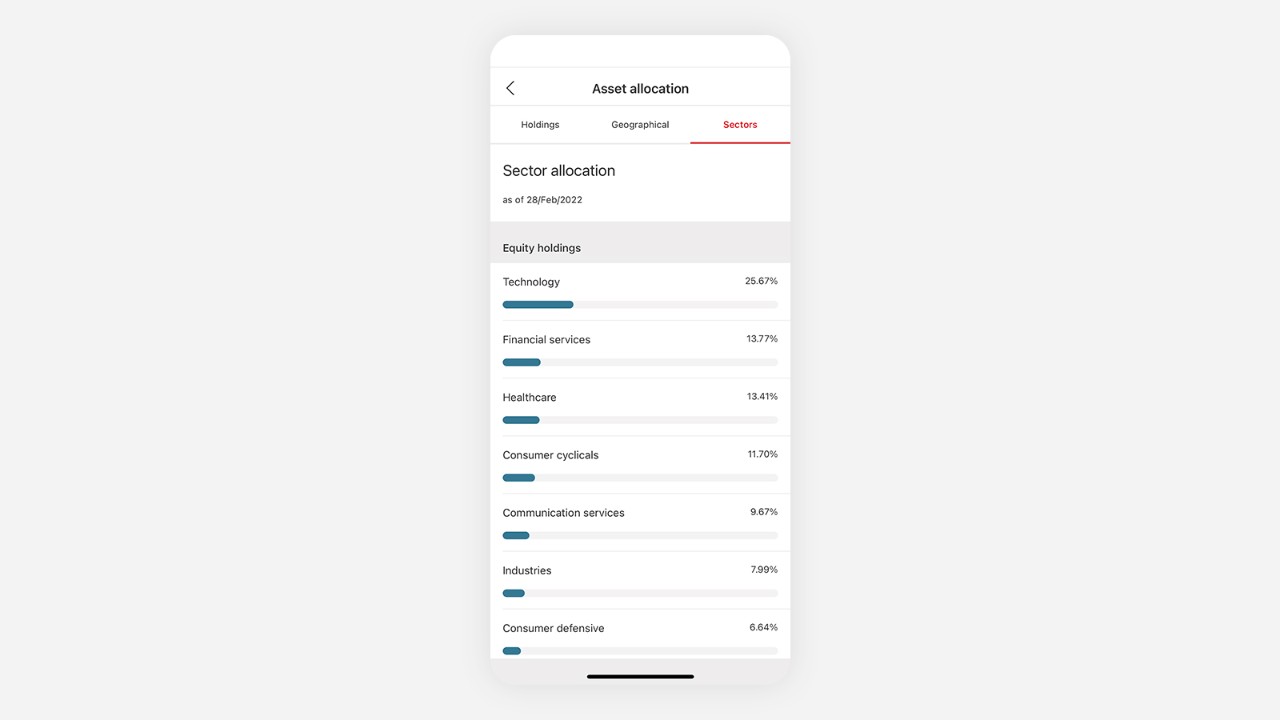

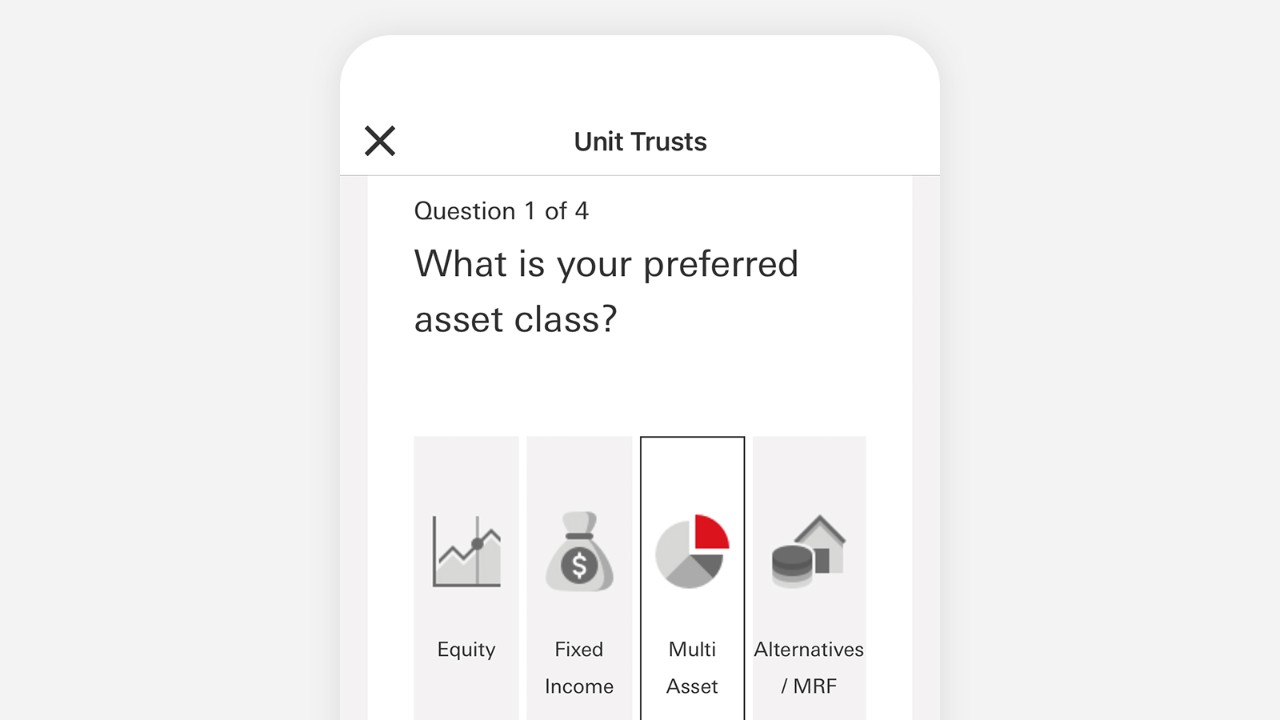

Step 2: Decide on your portfolio asset mix

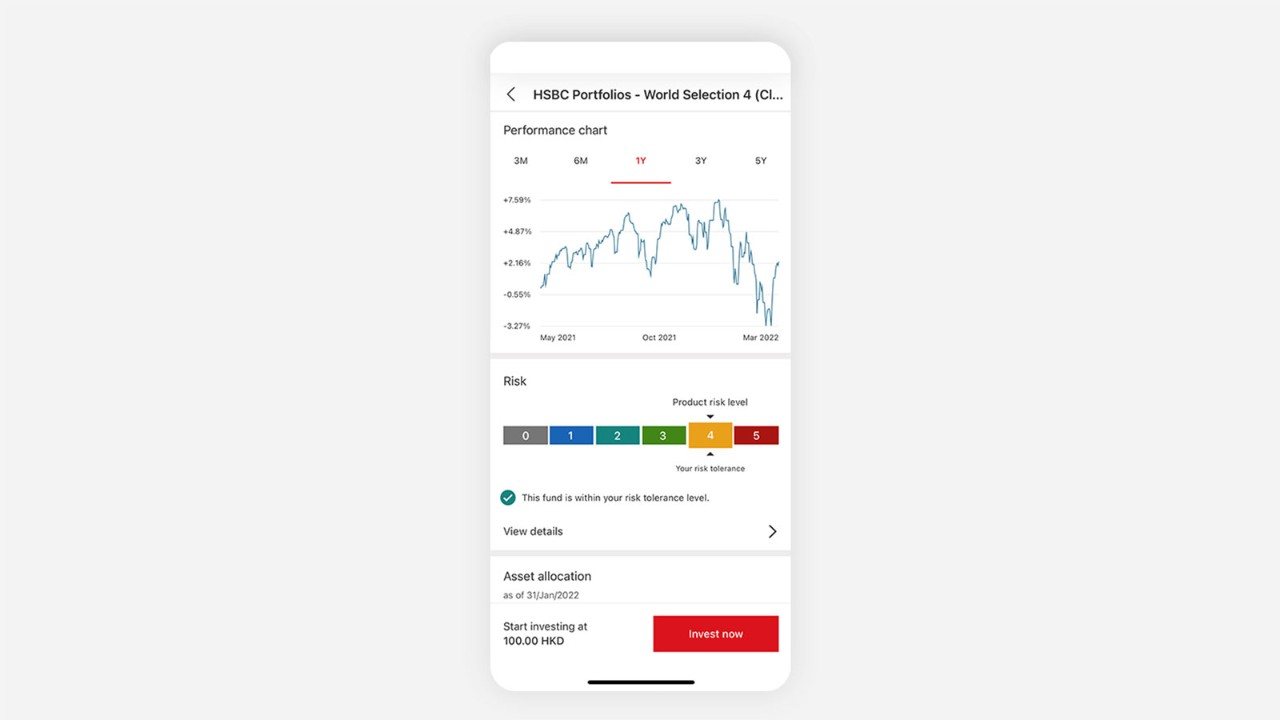

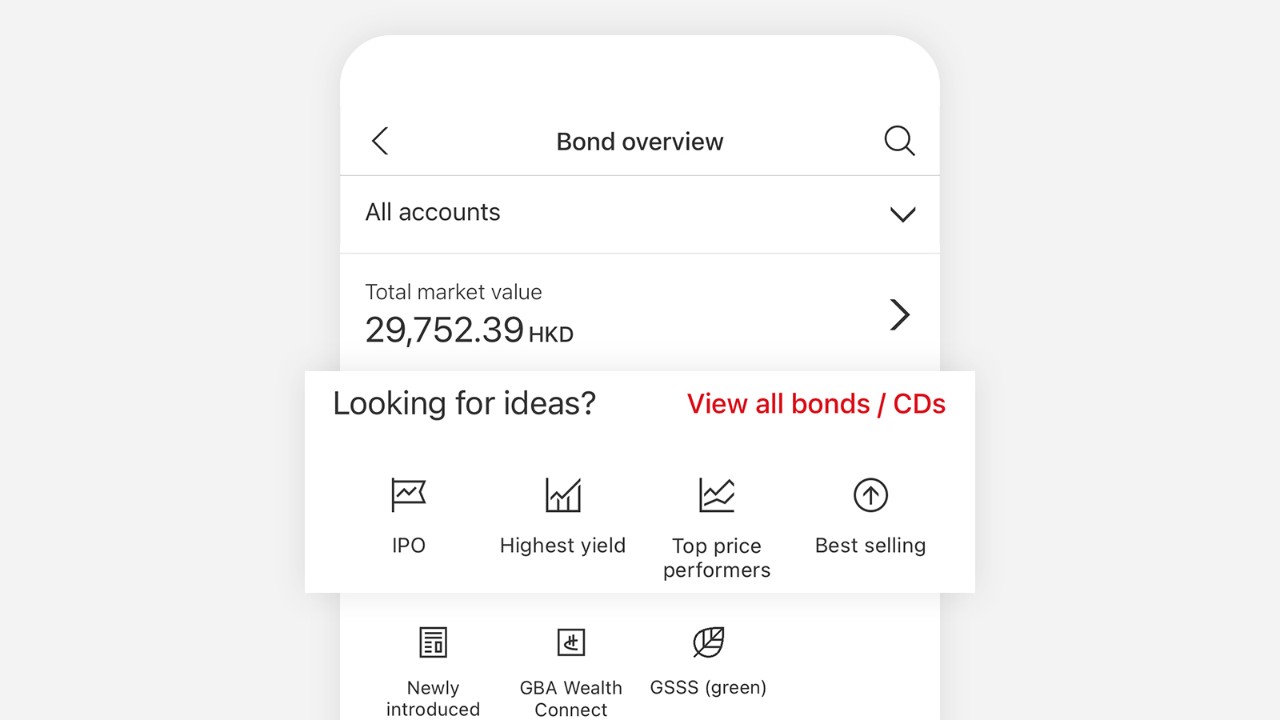

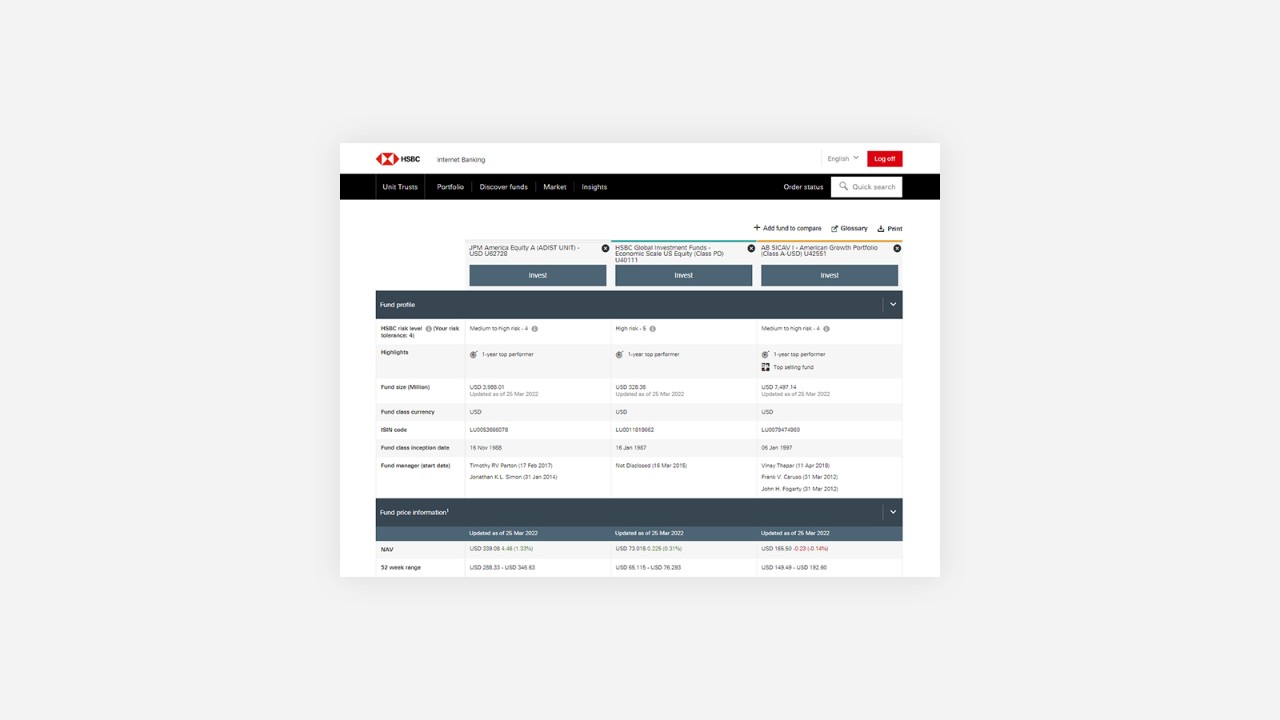

Step 3: Choose the right product

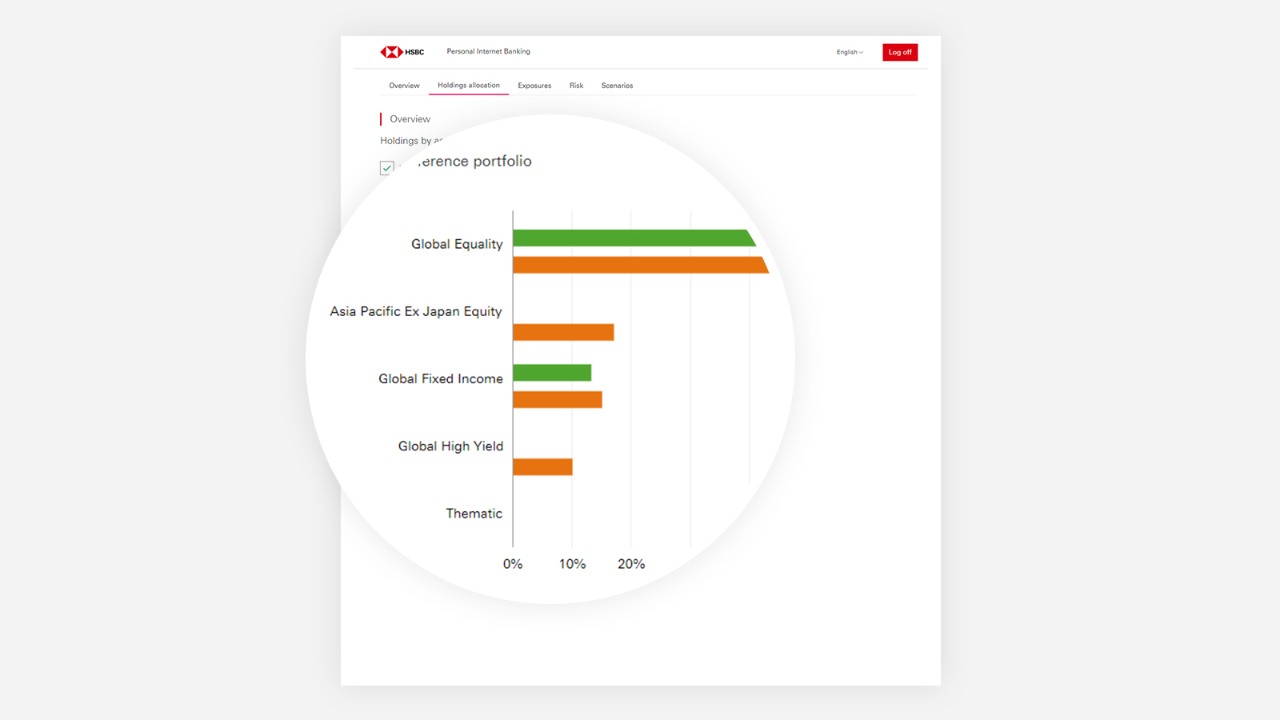

Step 4: Review your portfolio composition

Step 5: Track your performance and rebalance your holdings

Need more help?

Speak to your relationship managers

Contact your Relationship Director or Relationship Manager directly, or call us on:

- HSBC Premier Elite

Existing customers: (852) 2233 3033

New customers: (852) 2233 3377

- HSBC Premier

Existing customers: (852) 2233 3322

New customers: (852) 2233 3377

Is this guide helpful?

How can we do better to guide your investment journey with us?