Limited-time offers

- 10,000+ delights & more: Enjoy a wide range of offers at over 10,000 outlets as an HSBC customer. T&Cs apply. Learn more.

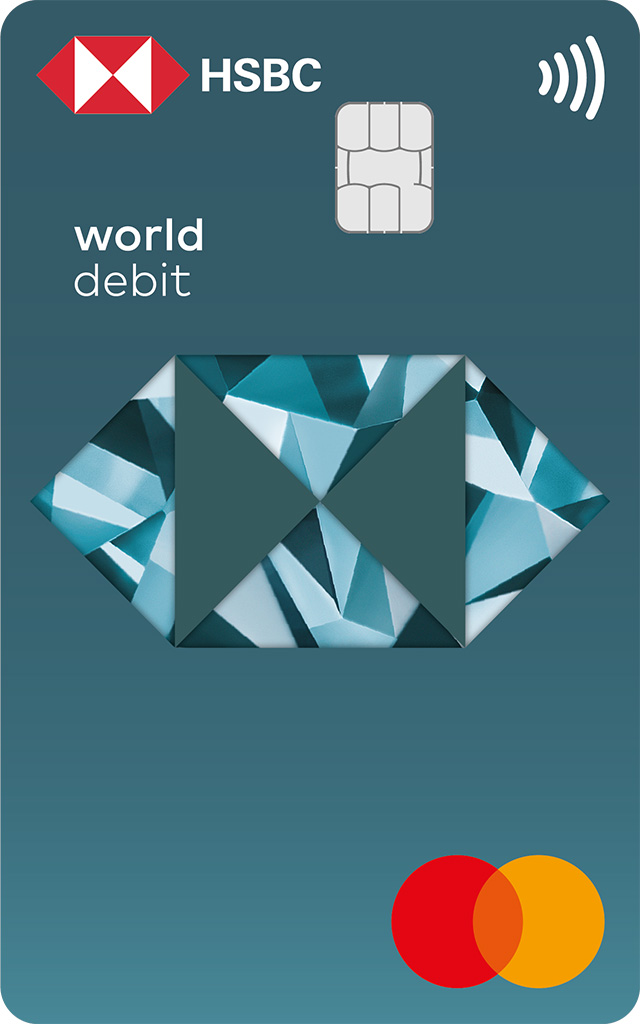

From now on, whether you're shopping at home or travelling abroad, staying in control of your global currencies has never been easier. With a card built around 12 major currencies, you can shop online, make purchases, and withdraw cash at HSBC Group ATMs around the world, with zero fees.

* You need to have an integrated account to apply.

Why you'll want it

Easy access to major currencies

Your purchases and cash withdrawals in 12 major currencies can be debited directly from the corresponding foreign currency deposits in your HSBC integrated account. These currencies include HKD, USD, GBP, JPY, RMB, EUR, THB, AUD, NZD, SGD, CAD and CHF. Any purchases outside of these currencies will be settled in HKD according to the prevailing exchange rate.$0 fees for all your purchases

No matter if you're making a purchase in store or shopping online, we won't charge you handling fees for any transactions at home or abroad.Free cash withdrawals worldwide

Withdraw cash from HSBC Group ATMs anywhere in the world, with no handling fees.Earn on every purchase

Enjoy a 0.4% cash rebate on all eligible purchases, alongside the money you'll save with $0 transaction fees.- Supplementary Debit Card for your loved onesA supplementary card gives your loved ones the benefits of multi-currency and fee-free privileges.

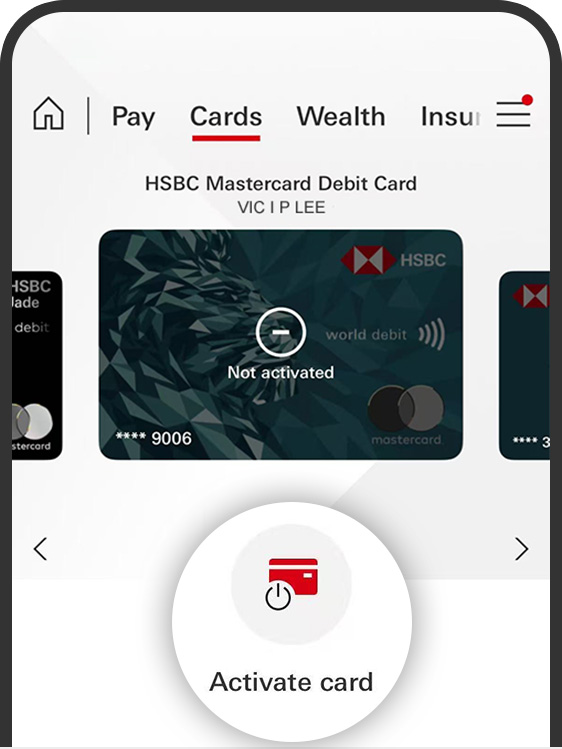

How to get your card ready

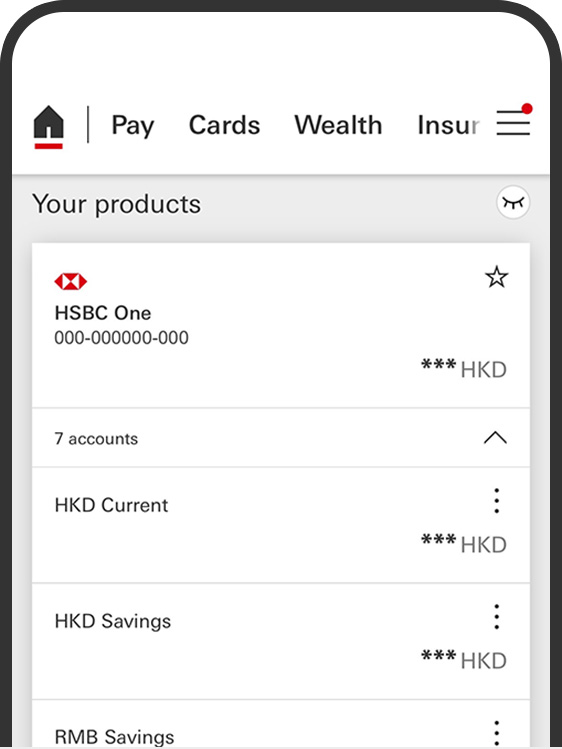

Get your card on mobile

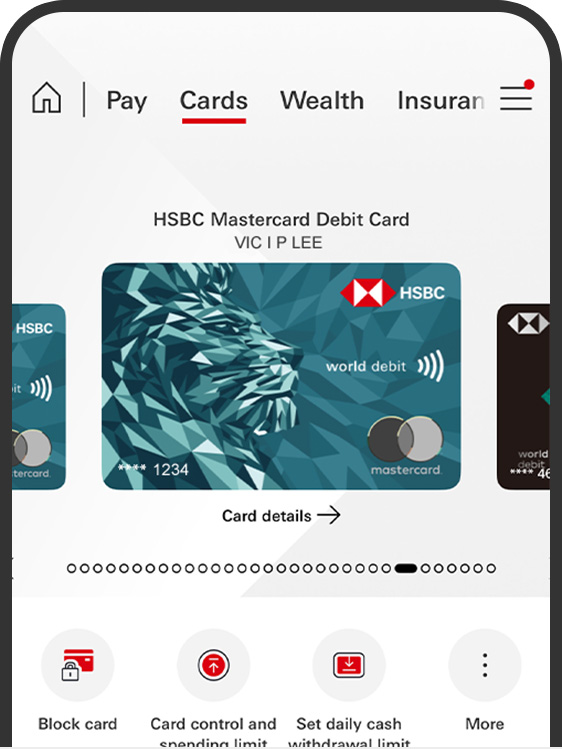

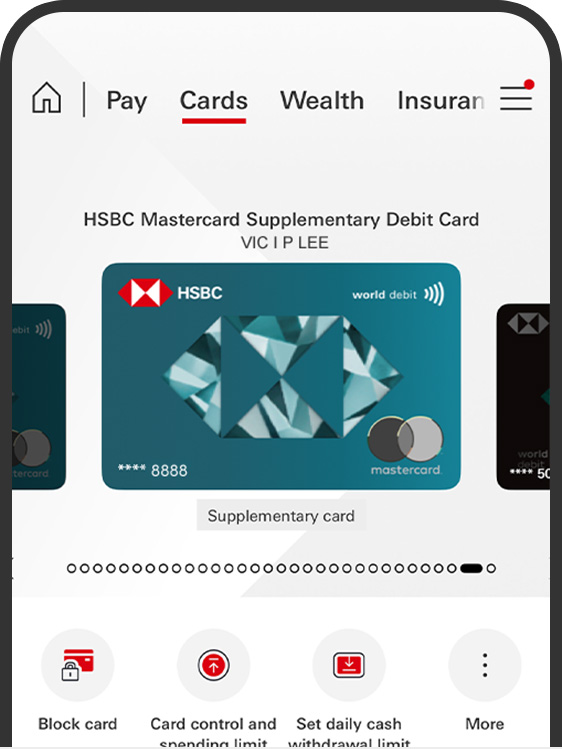

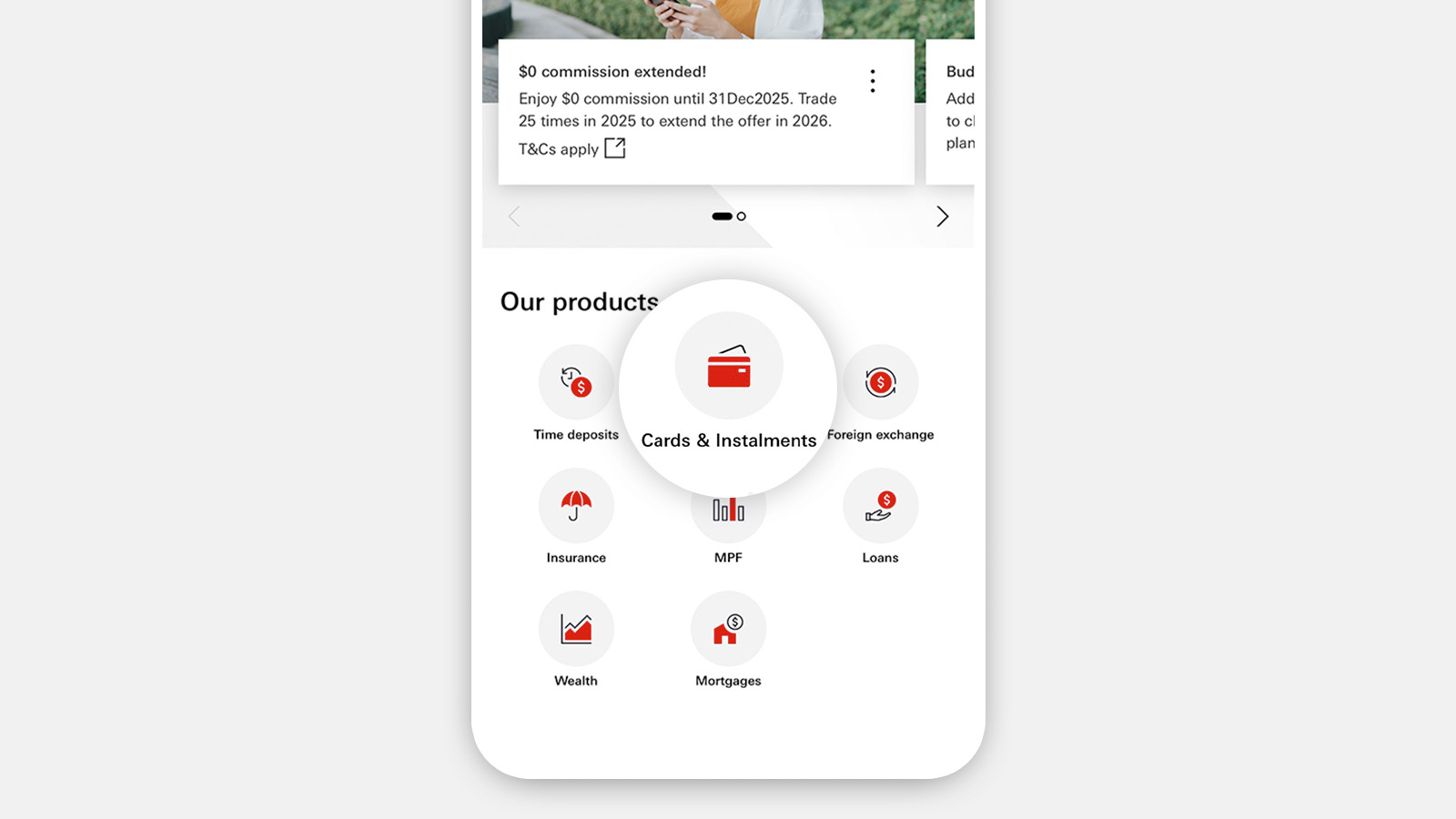

Already an integrated account holder? Apply for a debit card in the HSBC HK App and we’ll process your application right away. Simply log on, select the menu icon and choose 'Products', then go to 'Cards and instalments'.

Or you can contact us directly to apply for a card.

How to receive your card PIN (Personal Identification Number)

To protect the environment and reduce paper consumption, you will not receive your PIN by mail. After activating your debit card, set up your own card PIN via the HSBC HK App or call our hotline on (852) 3163 0633. It's fast and simple!

Eligibility

HSBC integrated account holders

Enjoy all the benefits of having a multi-currency card today.

Not an integrated account holder yet?

If you're opening a new HSBC Premier or HSBC One account, you may request for the HSBC Mastercard® Debit Card at the same time.1

Apply for a Supplementary Debit Card for your loved ones

A truly international multi-currency Debit Card for your loved ones, no matter where they go around the world.

Get your card in seconds with the HSBC HK App2

What else should I know

If you still hold a HSBC Jade Mastercard® Debit Card

Click here to view details

Remarks:

1. You can choose the HSBC Mastercard® Debit Card and/or the HSBC UnionPay ATM Card upon opening your new integrated account.

2. You need to have an integrated account to apply.

- Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- QR Code is a registered trademark of Denso Wave Incorporated.

- The screen displays are for reference and illustration purposes only.

- Terms and Conditions apply.

Disclaimer & risk disclosure:

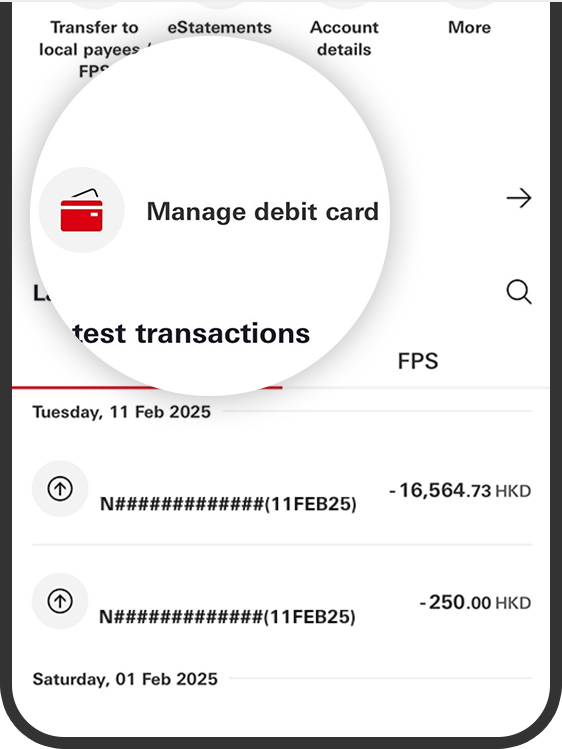

- By activating this card, you agree to the Debit Card Terms and Conditions and accept the preset daily spending limit as printed on the card mailer. Once the card is activated, if you'd prefer to lower your spending limit, you can adjust it anytime from the 'Manage debit cards' screen on your HSBC HK app or call our hotline as printed on the back of your card.

Once your replacement request is processed, or your renewal card is activated, your original card will become invalid. Please dispose of the invalid card safely by cutting it in half before discarding it. This will help keep you safe. - Currency conversion risk - The value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal.