Apply in just a few steps

You can apply for a Spending Instalment Plan any time on the Reward+ app with these simple steps:

- Log on to the app

- Follow the steps to complete your application

- Receive approval instantly[@cards-sip-instant-approval]

Don't have the app yet? You can download it from our Reward+ page.

Get started

To start, you'll need to be on the latest version of the Reward+ app.

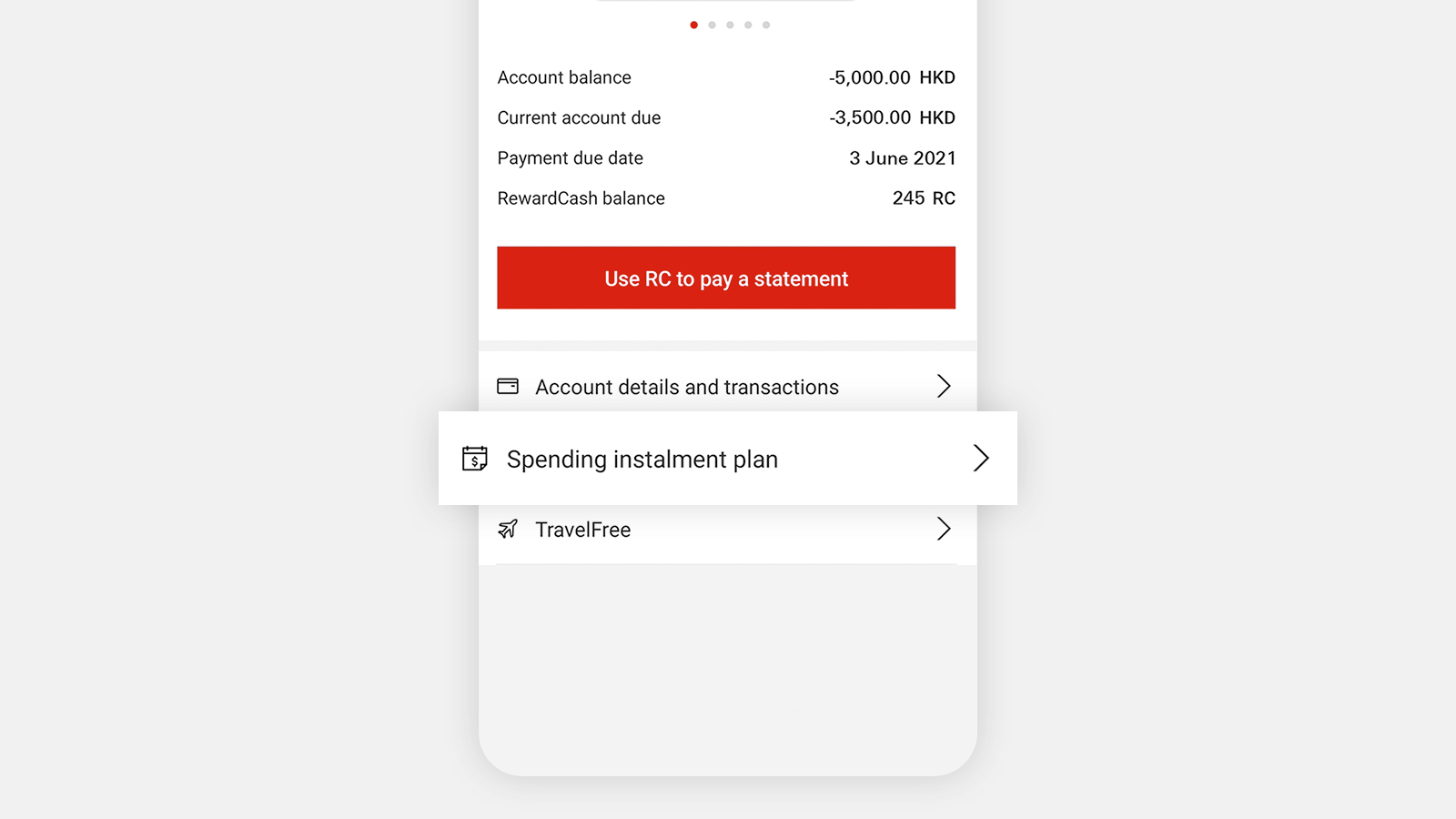

Step 1

Log on, go to 'Account' and select an eligible credit card, then choose 'Spending Instalment Plan'.

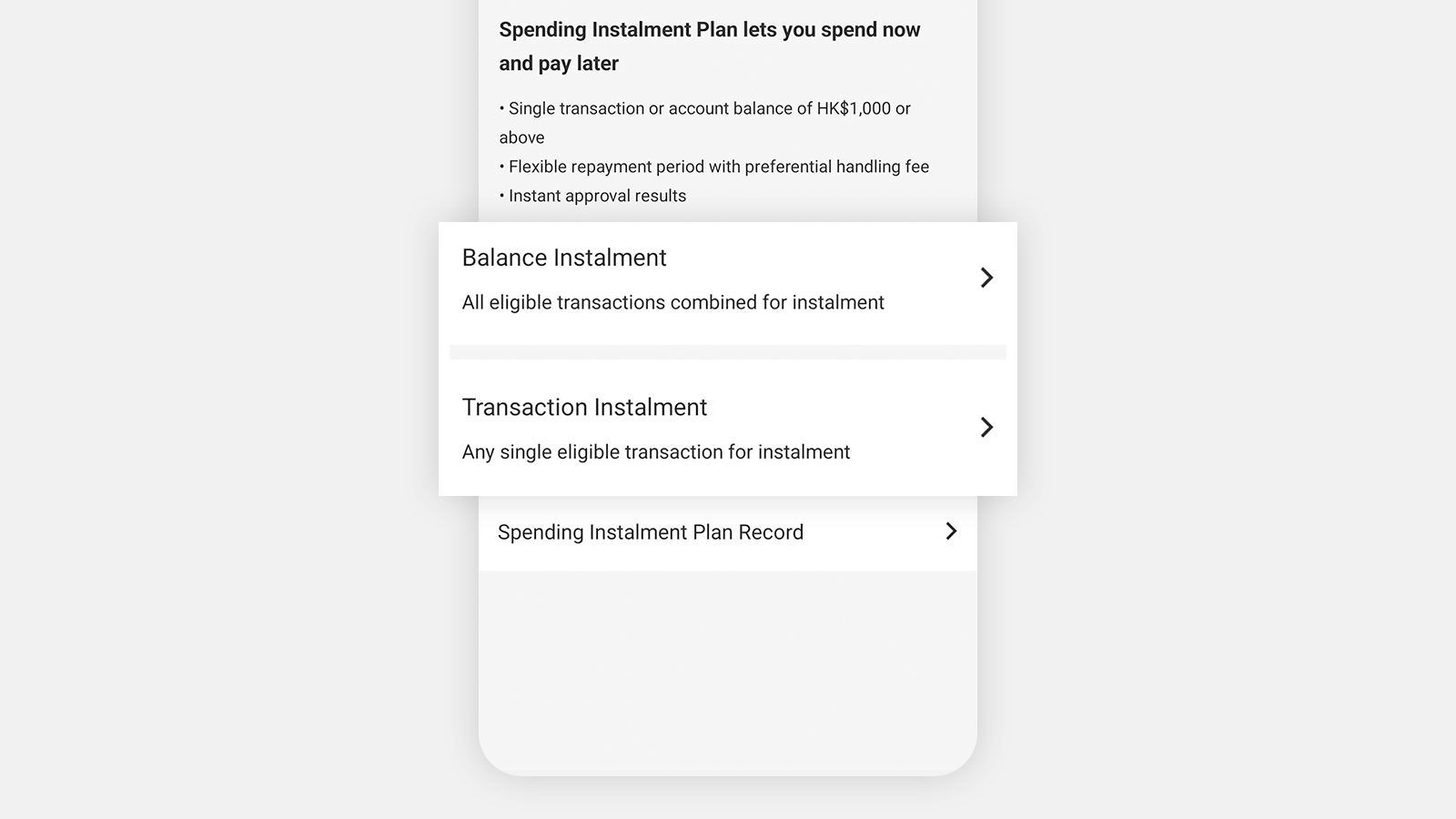

Step 2

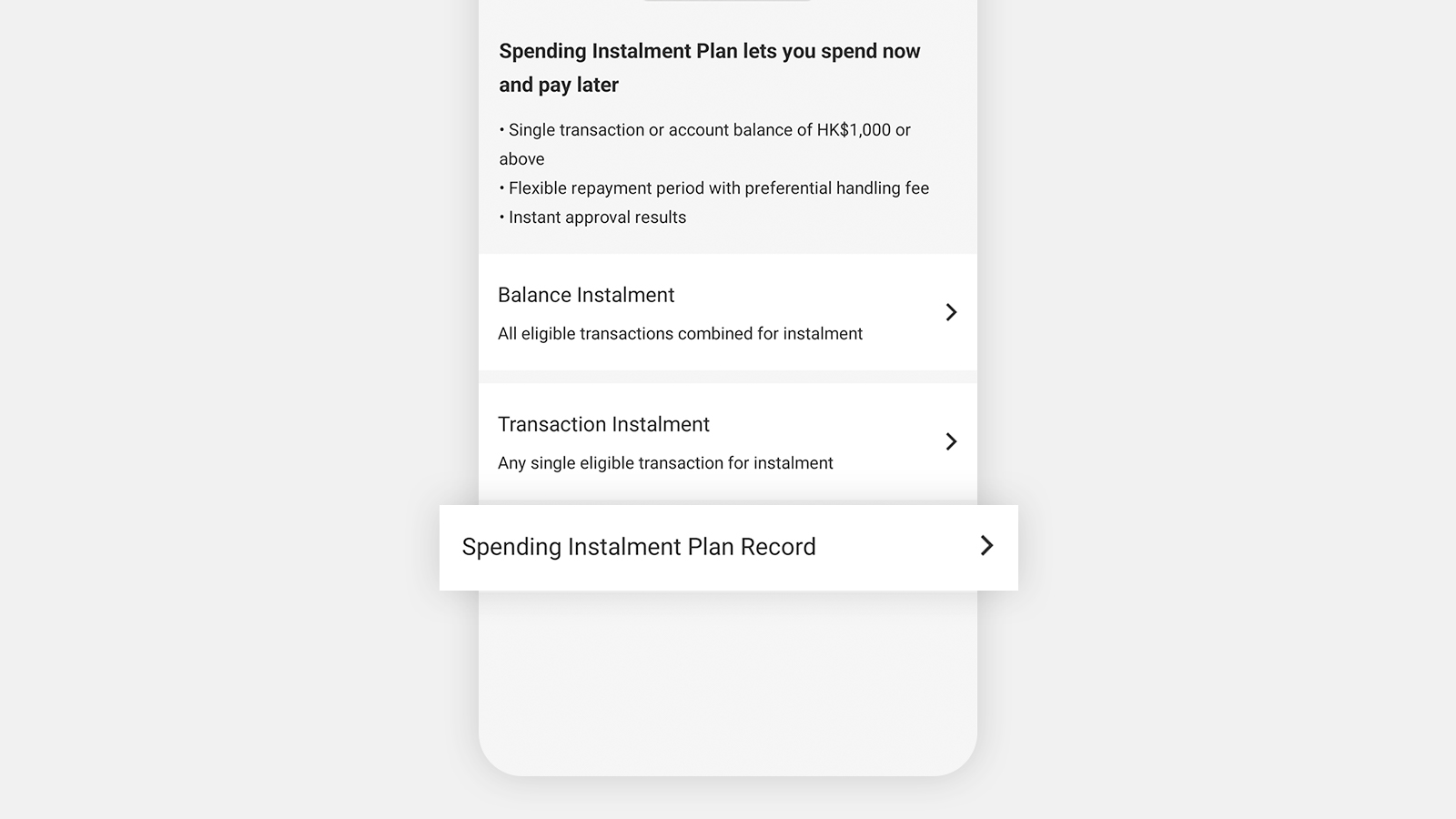

Tap the button on the screen to choose whether you want to split your account balance into multiple instalments or keep it as a single transaction.

3 easy steps to apply

Follow these steps to complete your application.

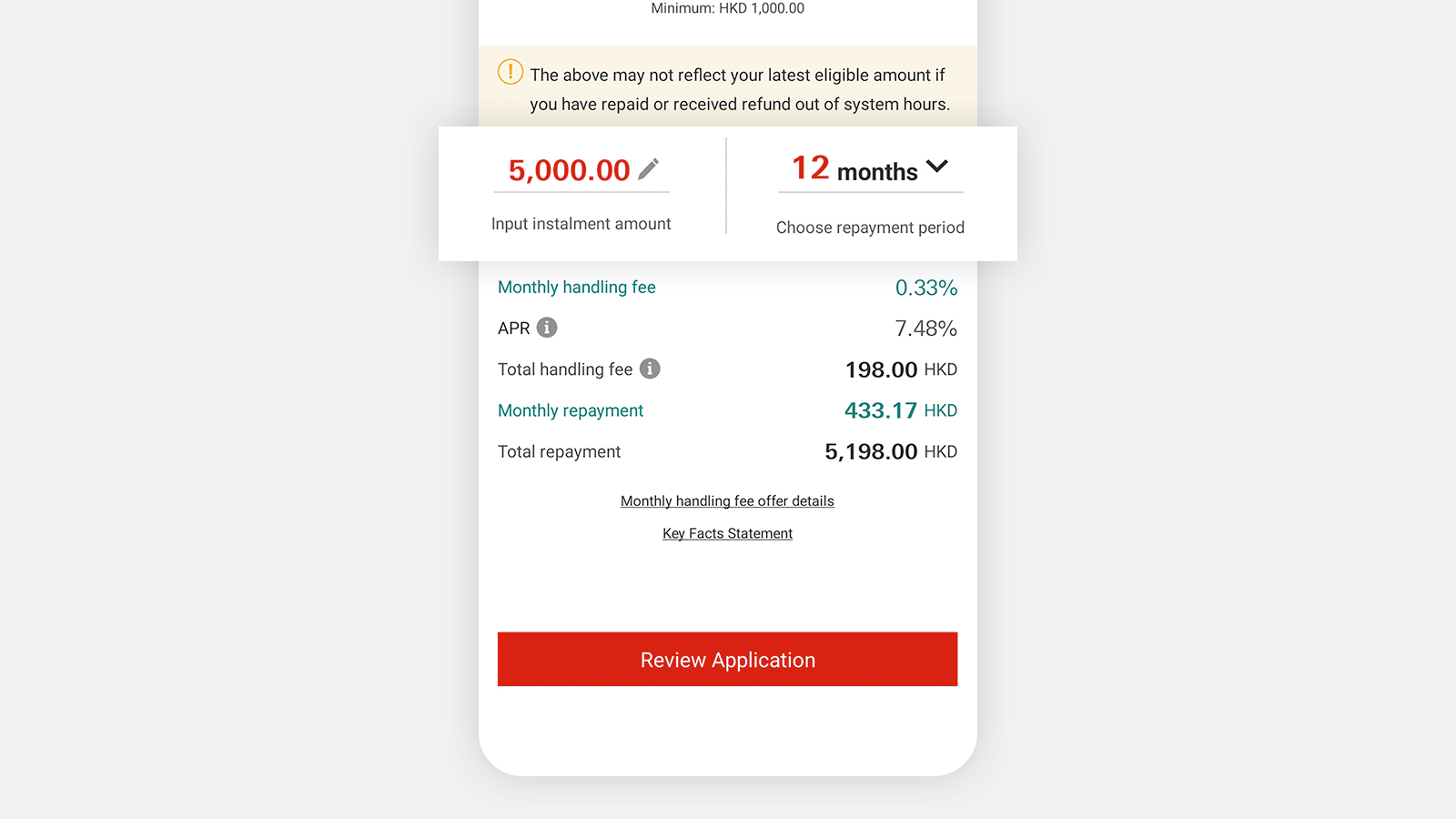

Step 1

Adjust the default instalment amount or repayment period if you need to. Tap ‘Review application’ to continue.

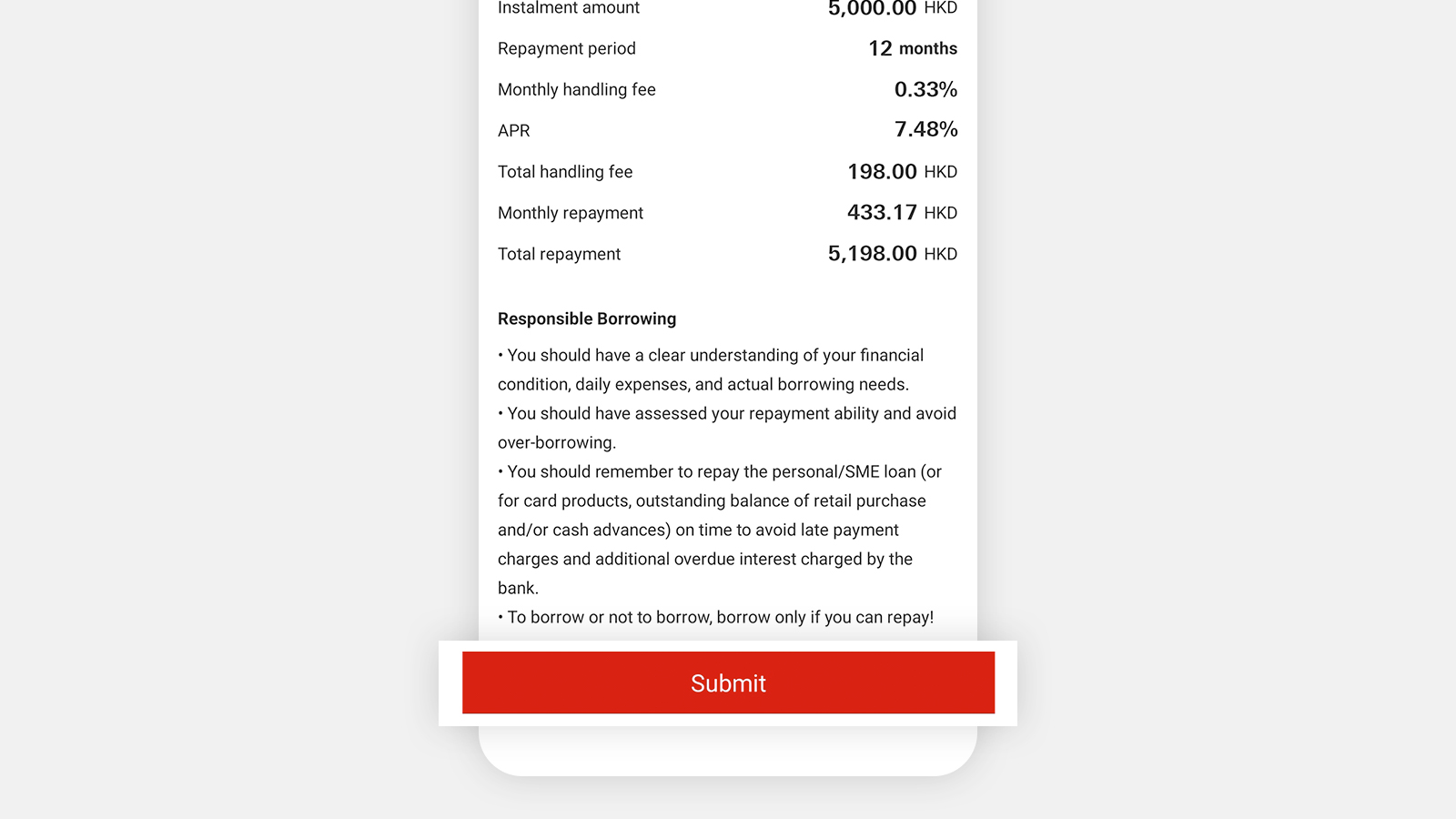

Step 2

Review your application details, then press ‘Submit’.

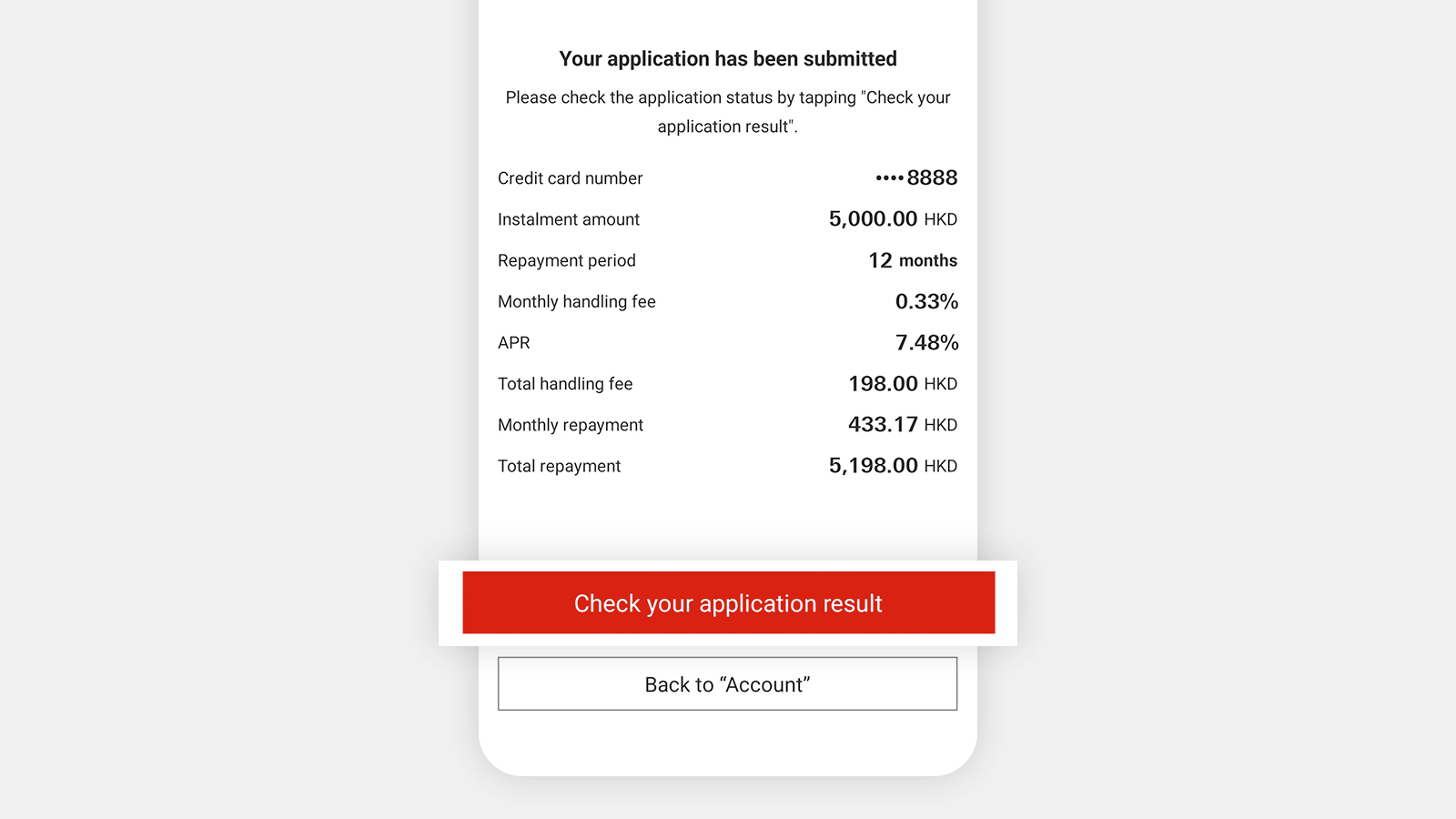

Step 3

You can select ‘Check your application result’ after submitting your application. Your application will be approved instantly and your plan will be set up right away[@cards-sip-instant-approval].

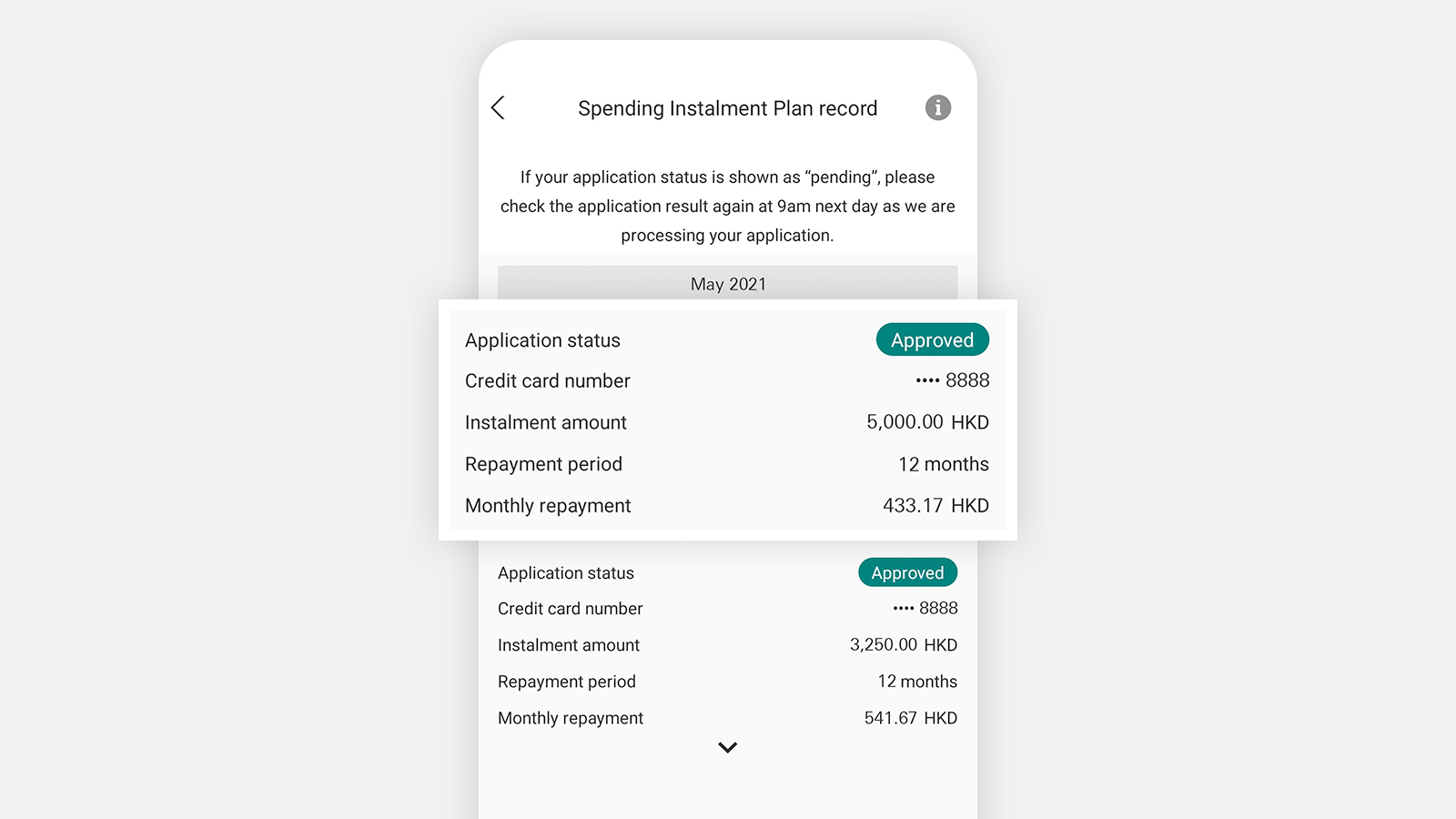

Check your application status

You can check the status of your application or the details of the plan instantly, at any time.

Step 1

Go to 'Account', then tap on the credit card you chose to use for the instalment plan.

Step 2

Choose 'Spending Instalment Plan', then 'Spending Instalment Plan record' for more information.