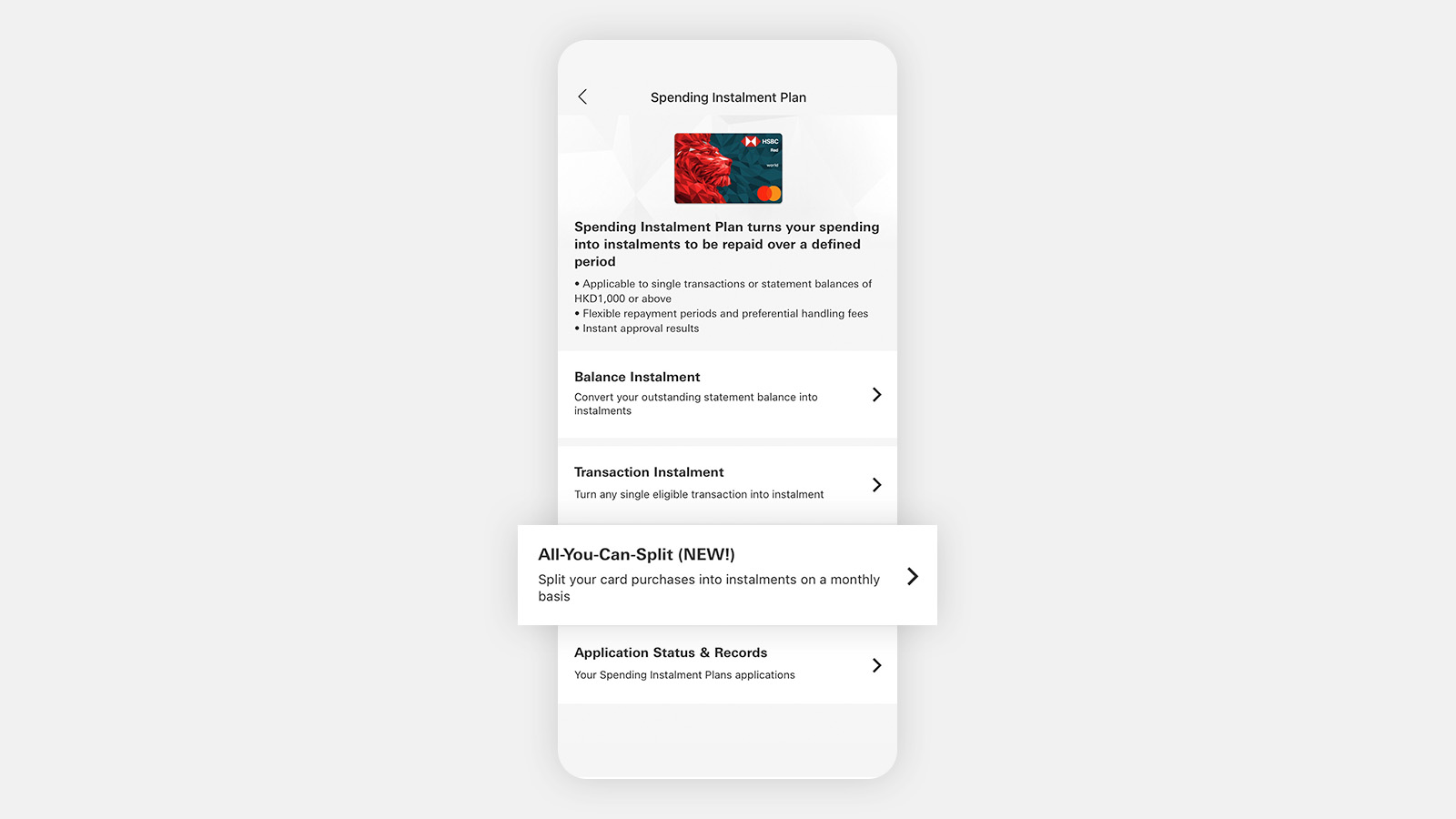

HSBC's "All-you-can-Split" sets up instalments for you automatically

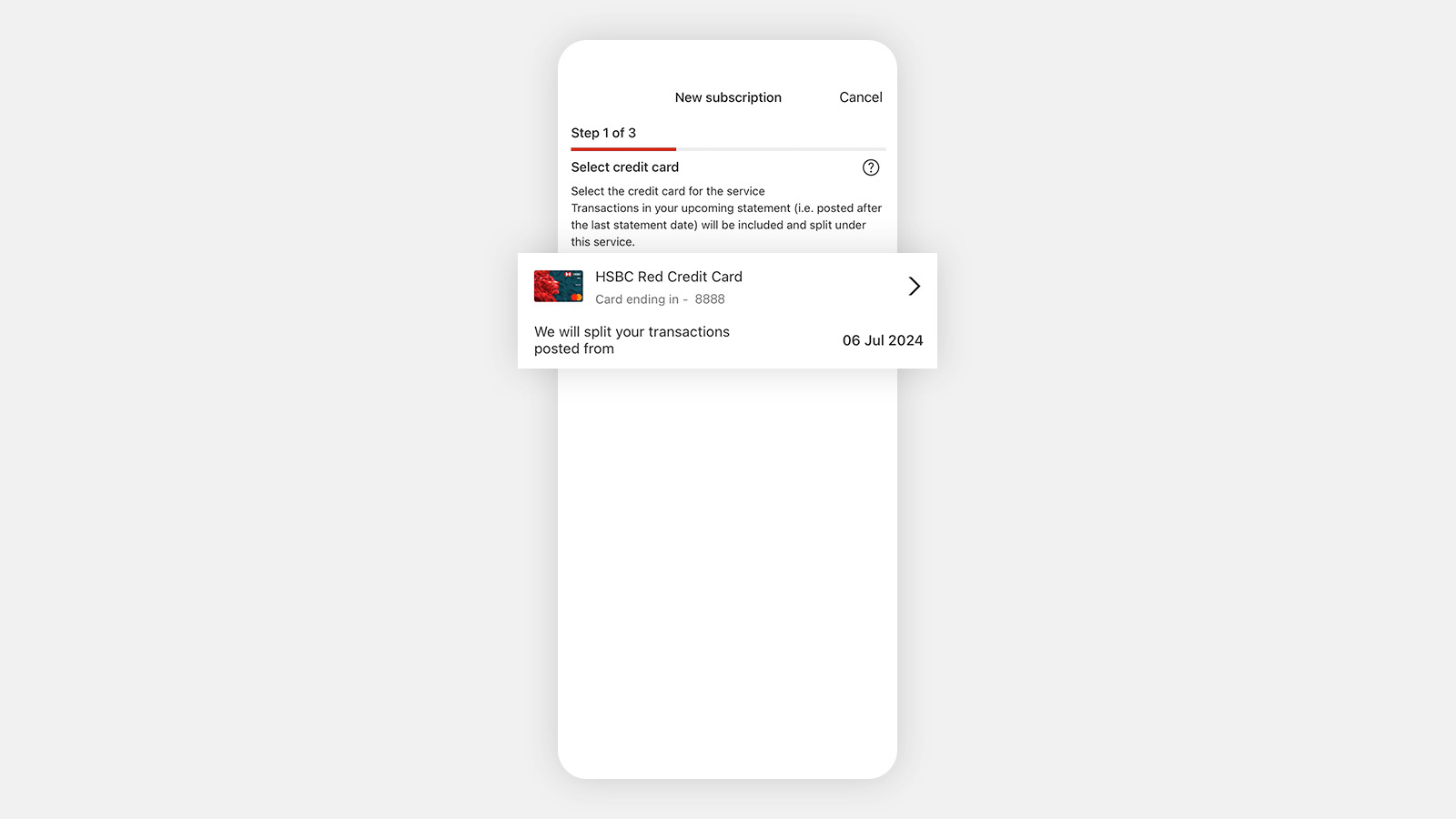

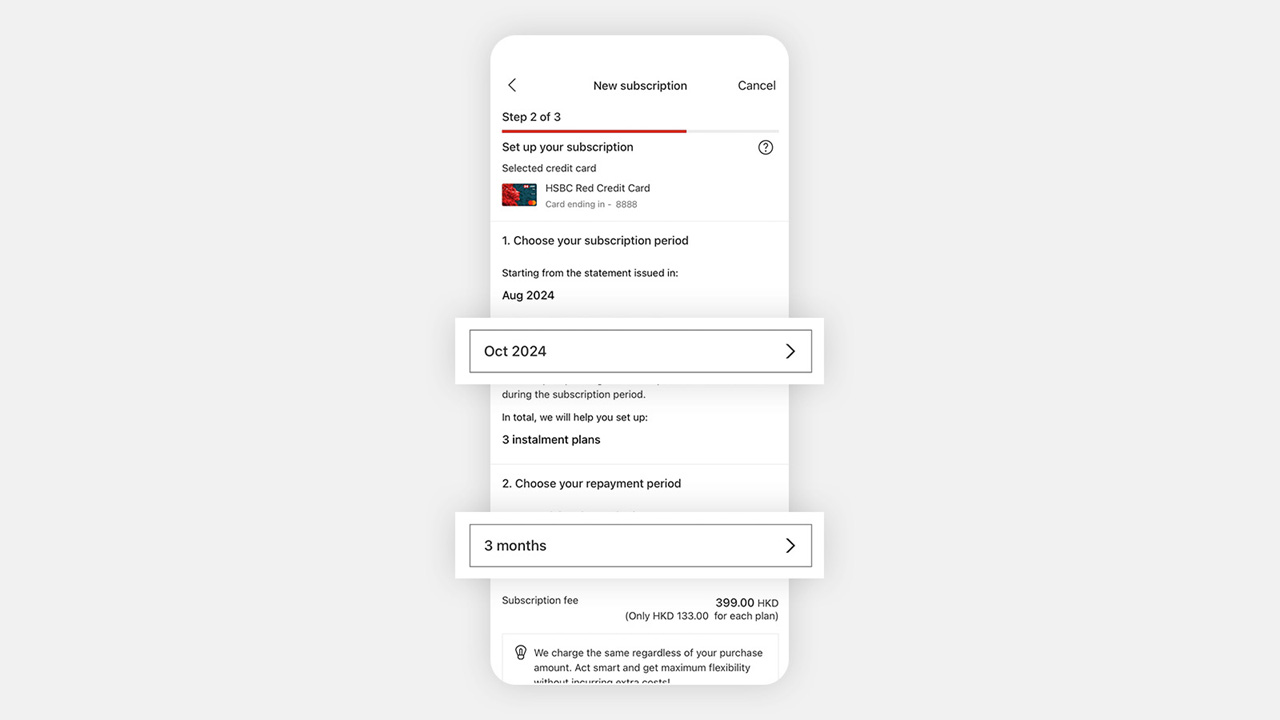

This is an extended feature of our spending instalment plans. Split your credit card purchases into spending instalment plans each month and manage your upcoming expenses with more flexibility.

One-off subscription fee

As low asHKD99[@cards-aycs-subscription-fee]

Limited-time offer - price down on subscription fee

From now until 3 Mar 2026, the one-off subscription fee will be reduced to as low as HKD99[@cards-aycs-subscription-fee]. This means you can auto-split your bills into instalments with a fee as low as just HKD1 per day - perfect for managing upcoming expenses!