What's important to you is important to us

HSBC Premier gives you more of the things you care about to make your life better.

- Wealth planning for today and tomorrowMake better choices for your family's future with our wealth management services and planning solutions, customised for your financial needs.

- Keep your health on trackMake the most of HSBC Premier's exclusive privileges in health protection, treatment and care, for you and your family.

- Bank seamlessly everywhereStay connected with the world anytime and anywhere through HSBC Premier and Global Account Management.

- Global education planning – Prioritise your family and the next generationOur one-stop solution to help you plan for different stages of your children's global education.

- Elevate your travel, dining and lifestyle experienceEnjoy a wide range of exclusive offers in travel, dining, lifestyle and entertainment with HSBC Premier.

Enjoy HSBC Premier Welcome Rewards worth over HKD50,000

Enjoy rewards worth over HKD50,000[@premier-welcome-rewards] and a Below Balance Fee waiver for 6 months[@premier-trb] when you apply for HSBC Premier and complete designated banking transactions from 1 April to 30 June 2025. T&Cs apply.

Premier is more than just banking

Our wide range of account features and benefits elevate many different aspects of your life.

Wealth planning for today and tomorrow

Leverage and adapt to various circumstances with comprehensive support from HSBC Premier, whether they pertain to immediate personal objectives or long-term endeavours involving your family and loved ones.

Global education planning – Prioritise your family and the next generation

We offer a comprehensive solution to help you plan for different stages of your children's global education journey. Take advantage of our pioneering HSBC Premier Chief Education Officer service, which includes a 1:1 consultation with an esteemed education partner, plus a host of other exclusive global education privileges[@premier-ie-tncs].

Keep your health on track

Enhance the health and wellness of you and your family with HSBC Premier's comprehensive support. Enjoy exclusive healthcare privileges and tailored offers across prevention, health protection and treatment stages.

Elevate your travel, dining and lifestyle experience

Indulge in an elevated lifestyle with HSBC Premier's range of exclusive offers in travel, dining, lifestyle and entertainment experiences.

Bank seamlessly everywhere

Manage your finances online anytime, anywhere in the world. From international payments and foreign exchange to account opening in new locations and international mortgage referral assistance – we've got you covered.

Discover how HSBC Premier gives you more

We provide lots of ways to elevate your everyday.

Who can apply?

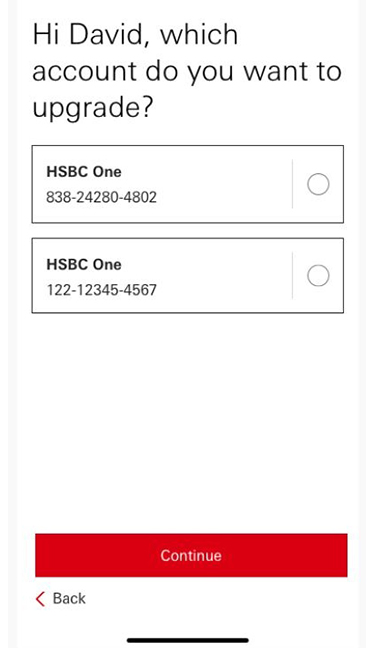

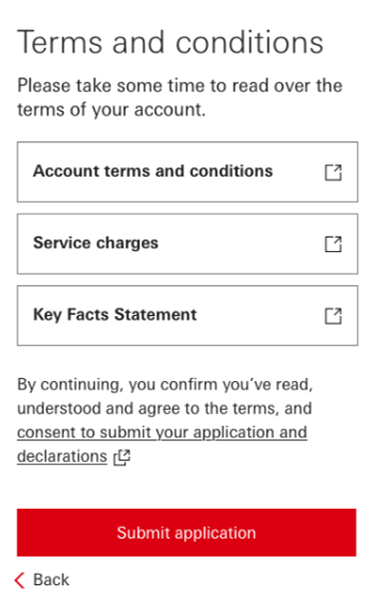

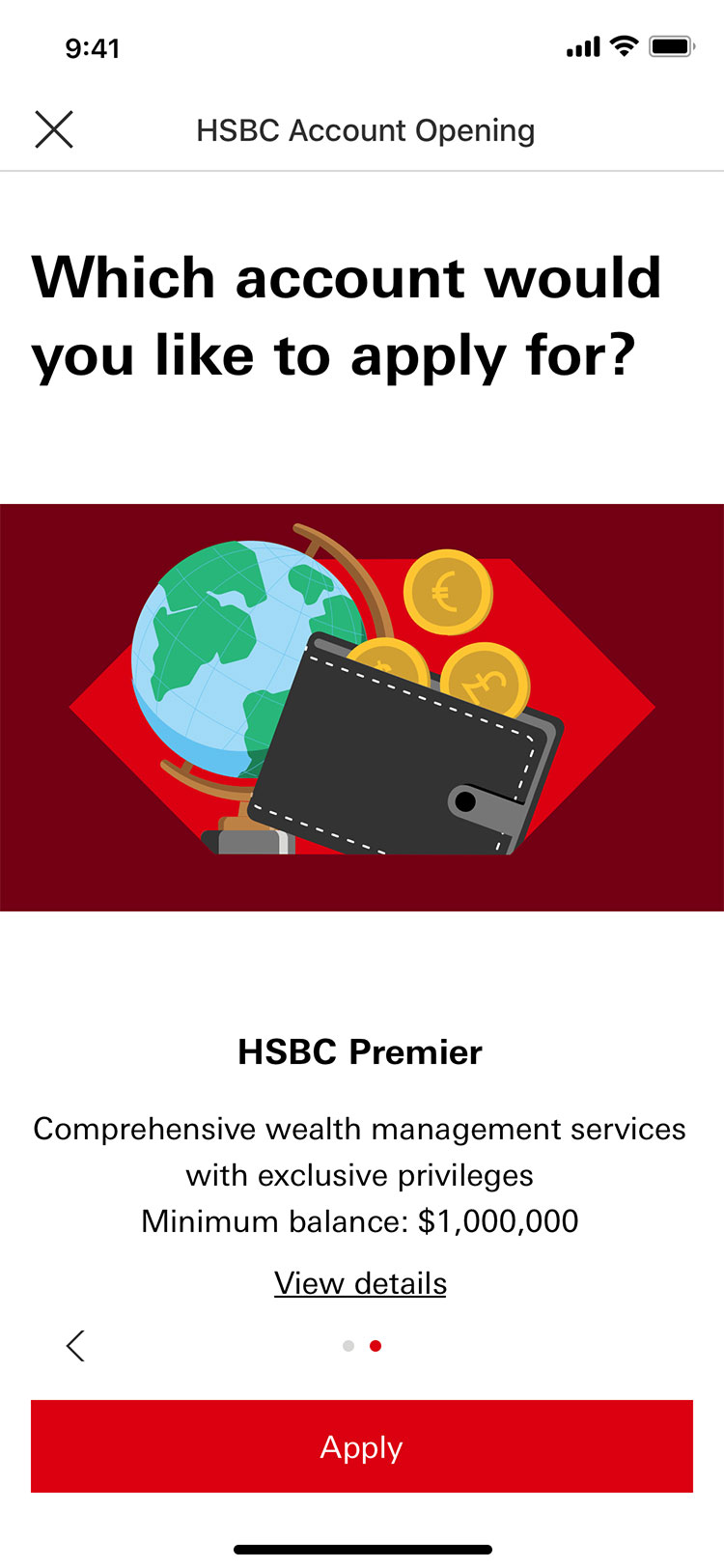

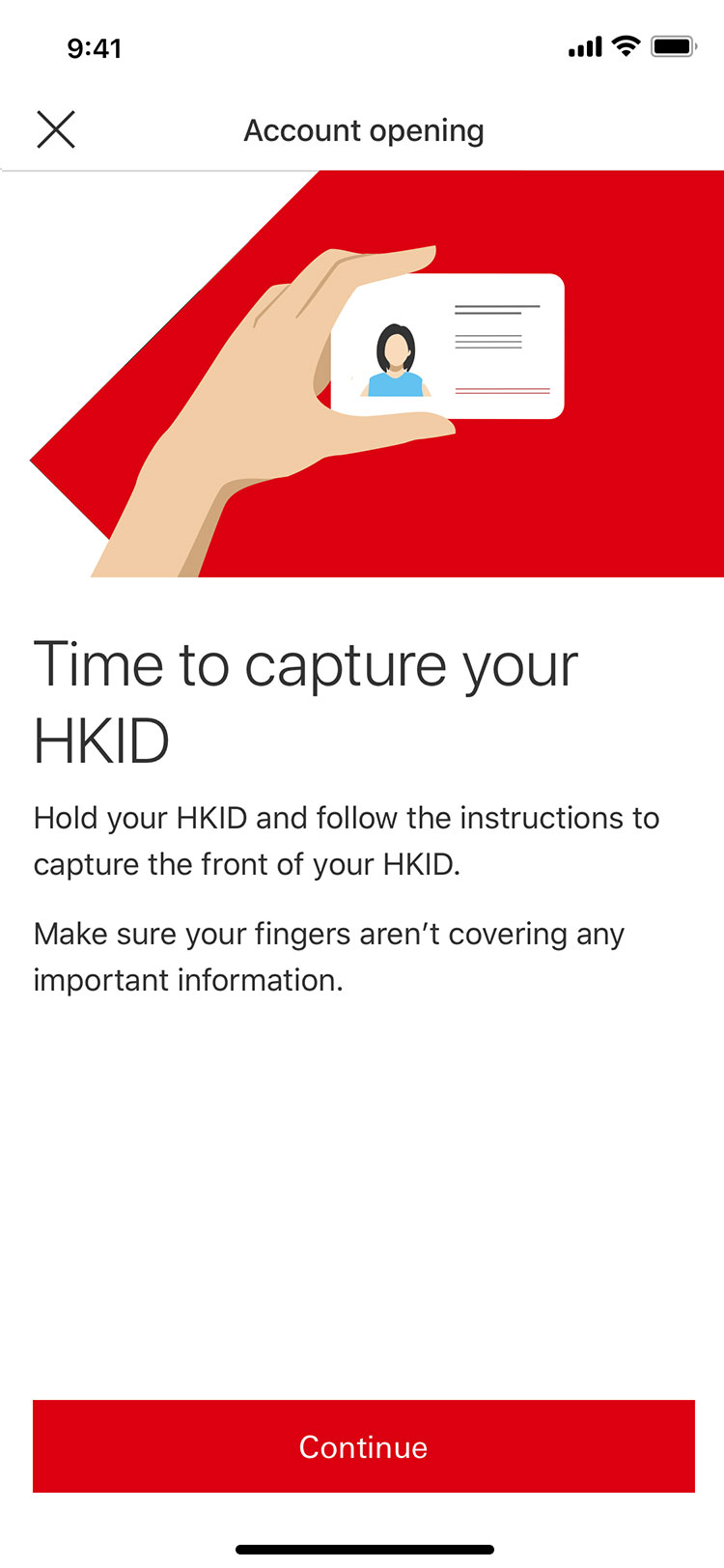

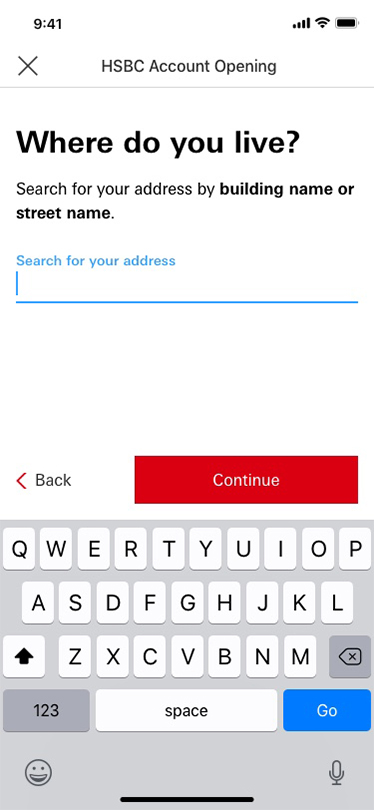

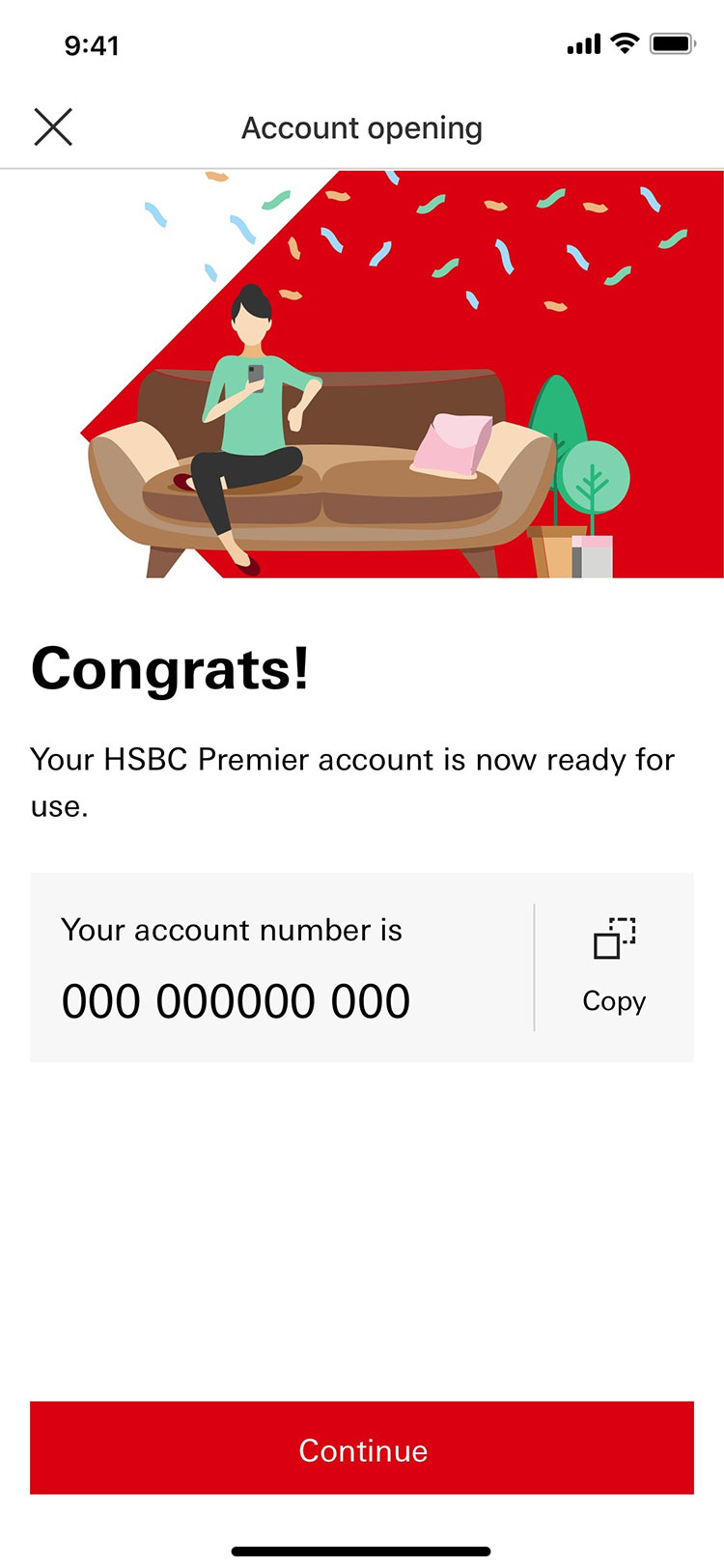

Open an HSBC Premier Bank Account

Open an HSBC Premier account as a new customer or upgrade your existing HSBC One, Personal Integrated Account, standalone HSBC deposit accounts, via HSBC HK Mobile Banking app[@premier-apply-via-app] in less than 5mins.

If you're on a desktop scan the QR code with a mobile device to apply on the app.

Other ways to apply

Additional information

You might also be interested in

Notes

Apple, the Apple logo, iPhone, Touch ID and Face ID are trademarks of Apple Inc., registered or in the process of being registered in the US and other countries / regions.